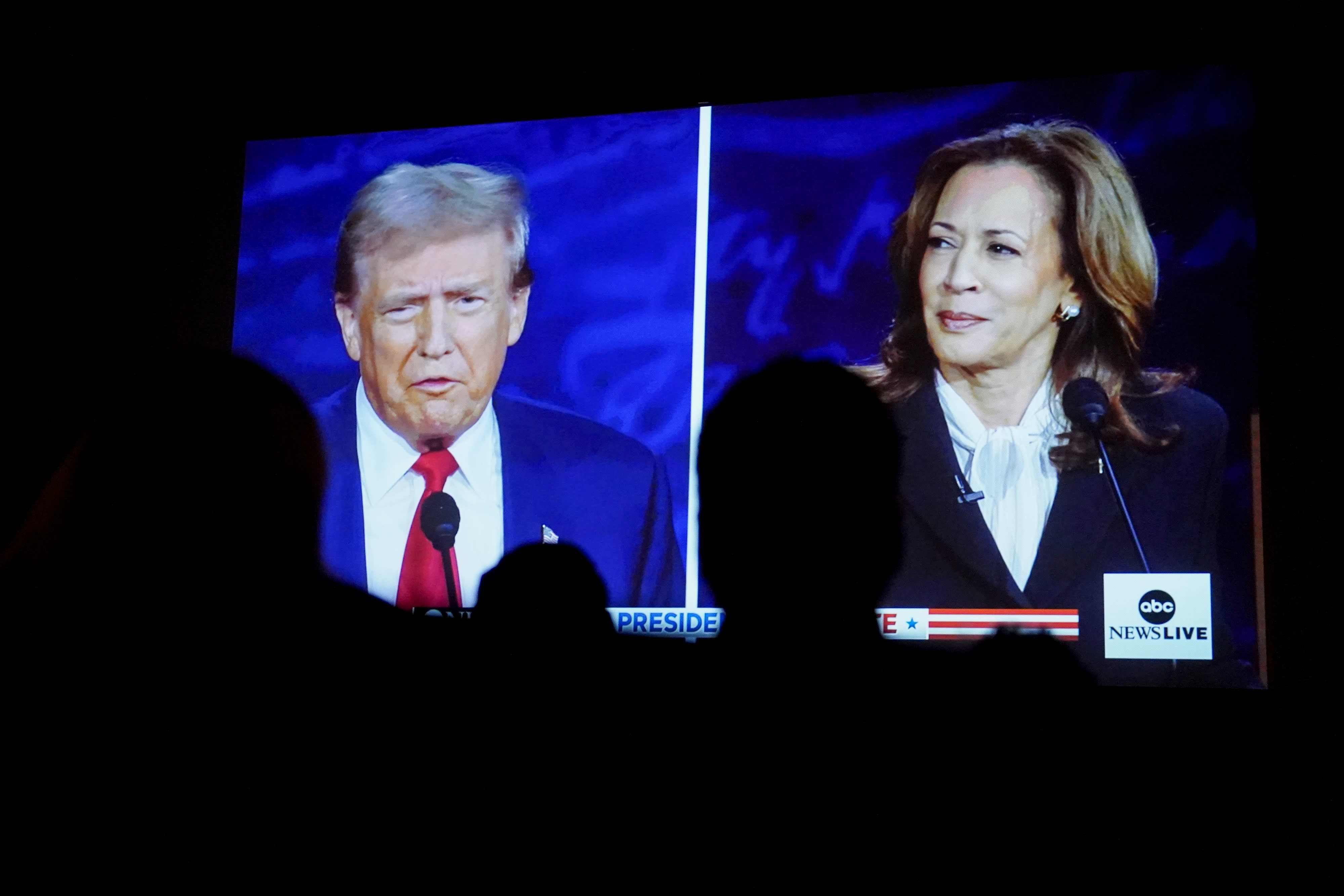

What are the 2024 stakes for airlines, banks, EVs, and health care under Trump or Harris?

- The outcome of the presidential election could lead to significant differences in the regulations, mergers, and taxes faced by airlines, banks, electric vehicle makers, health-care companies, media firms, restaurants, and tech giants.

- If Donald Trump wins a second term as president, he is likely to implement similar policies, including reducing corporate tax rates, imposing tariffs on Chinese goods, reducing regulation and red tape, and discouraging immigration.

- Insiders anticipate that Vice President Kamala Harris will generally maintain President Biden's policies, including his crusade against "junk fees" in various sectors, but there is a possibility of a more tempered strategy.

As the U.S. election approaches, the nation and its businesses face two starkly contrasting possibilities.

The outcome of the presidential election could significantly impact the rules, mergers, and taxes faced by airlines, banks, electric vehicle makers, health-care companies, media firms, restaurants, and tech giants.

If former President Donald Trump wins a second term, he is likely to implement similar policies, including reducing the corporate tax rate, imposing tariffs on Chinese goods, cutting regulation and red tape, and discouraging immigration.

While Vice President Kamala Harris has endorsed raising the corporate tax rate from 21% to 28%, most business executives anticipate that she will generally continue President Joe Biden's policies, including his campaign against "junk fees" in various sectors.

The outcome of the presidential race will not be fully understood until the winner makes appointments for key positions, such as those at the Treasury, Justice Department, Federal Trade Commission, and Consumer Financial Protection Bureau.

The 2024 presidential election will have significant implications for major corporate sectors, as CNBC analyzed the potential outcomes under a Harris or Trump administration.

Airlines

The outcome of the presidential election may impact various aspects, including the compensation airlines owe customers for flight cancellations and the cost of constructing aircrafts in the US.

The Biden Department of Transportation, under the leadership of Secretary Pete Buttigieg, has adopted a firm stance on addressing what it deems to be gaps in air traveler safeguards. The department has introduced or proposed new regulations on topics such as refunds for cancellations, family seating arrangements, and service fee disclosures, a move that airlines have contested in legal proceedings.

Jonathan Kletzel, head of the travel, transportation and logistics practice at PwC, stated, "The individual occupying the DOT seat is of great importance."

The current Democratic administration has successfully blocked two antitrust lawsuits that would have allowed a partnership between and in the Northeast and JetBlue's plan to acquire a budget carrier.

The Trump administration did not prioritize consumer protection measures. According to industry representatives, they anticipate a more advantageous climate for mergers under Trump, despite the fact that four airlines currently control over three-quarters of the US market.

The aerospace industry and its numerous suppliers prioritize stability above all else.

Trump has stated on the campaign trail that he supports additional tariffs of 10% or 20% and higher duties on goods from China. This could increase the cost of producing aircraft and other components for aerospace companies, as a labor and skills shortage after the pandemic also drives up expenses.

If tariffs lead to retaliatory taxes or trade barriers, it could harm the industry, particularly Boeing, a top U.S. exporter that relies heavily on sales to China and other major buyers of aircraft.

— Leslie Josephs

Banks

This year, big banks like faced a wave of new rules, with Biden appointees proposing the most comprehensive set of regulations since the aftermath of the 2008 financial crisis.

If Trump is elected, the fate of measures that generate tens of billions of dollars in industry revenue by imposing fees on credit cards and overdrafts and altering banks' capital and risk frameworks is uncertain.

Trump may nominate appointees for key financial regulators, such as the CFPB, SEC, OCC, and FDIC, which could lead to the weakening or elimination of numerous rules currently in effect.

According to Tobin Marcus, head of U.S. policy at Wolfe Research, the Biden administration's regulatory agenda, particularly in finance, has been very ambitious, and if Trump wins, a significant portion of it may be rolled back by his appointees.

If the Biden era's aspects, such as an aggressive CFPB and regulators who discouraged most mergers and prolonged deal approvals, were lessened, bank CEOs and consultants would find relief.

The CEO of a bank with nearly $100 billion in assets stated that it is advantageous for the industry if the president is Republican and there is a Republican sweep in Congress, as this would increase the chances of favorable outcomes from regulators.

Some observers suggest that Trump 2.0 may not be as favorable to the industry as his initial term in office.

Trump's vice presidential candidate, Senator JD Vance from Ohio, frequently criticizes Wall Street banks, and Trump recently proposed capping credit card interest rates at 10%, which would have significant consequences for the industry if implemented.

Experts suggest that it may be challenging to approve agency heads if they are deemed partisan picks, as Democrats need to control both chambers of Congress and the presidency in order to do so. Bankers also predict that Harris may not necessarily adhere to traditional Democratic Party ideals that have made life more difficult for banks.

Lindsey Johnson, head of the Consumer Bankers Association, a trade group for big U.S. retail banks, stated that she would not dismiss the vice president as someone who would definitely become more progressive.

— Hugh Son

EVs

The auto industry in swing states, such as Michigan, is facing uncertainty due to the polarizing nature of electric vehicles (EVs) between Democrats and Republicans. If Trump regains power, there could be significant changes in regulations and incentives for EVs, leaving the industry in a temporary limbo.

"Pablo Di Si, CEO of Volkswagen Group of America, stated during an Automotive News conference on Sept. 24 that the outcome of the U.S. election will determine whether there will be mandates or not. He added that he will not make any decisions on future investments until the results of the election are known."

Trump and the Republican party have largely criticized electric vehicles (EVs), arguing that they are being imposed on consumers and will harm the U.S. automotive industry. Trump has pledged to repeal or weaken many vehicle emissions standards under the Environmental Protection Agency and provide incentives to encourage the production and use of these vehicles.

If elected, he is predicted to renew a fight with California and other states that establish their own vehicle emissions standards.

UBS analyst Joseph Spak stated in a Sept. 18 investor note that with a Republican victory, there would be greater variation and potential for change.

Democrats, including Harris, have traditionally advocated for EVs and incentives, such as those included in the Biden administration's Inflation Reduction Act.

Despite recent slower-than-expected consumer adoption of EVs and consumer pushback, Harris has not been as vocal a supporter of EVs as she once was. She has stated that she does not support an EV mandate such as the Zero-Emission Vehicles Act of 2019, which she cosponsored during her time as a senator. However, auto industry executives and officials expect a Harris presidency to be largely a continuation, though not a copy, of the past four years of Biden's EV policy.

The IRA billions of dollars in incentives are expected to remain unchanged, while some leniency on federal fuel economy regulations is anticipated.

— Mike Wayland

Health care

The U.S. health-care system, consisting of doctors, insurers, drug manufacturers, and middlemen, is costly, complicated, and entrenched, and has been called for reform by both Harris and Trump, with an annual cost of over $4 trillion.

Although the U.S. spends more on healthcare than any other wealthy country, it has the lowest life expectancy at birth, the highest rate of people with multiple chronic diseases, and the highest maternal and infant death rates, according to the Commonwealth Fund, an independent research group.

A May poll by health policy research organization KFF found that roughly half of American adults find it difficult to afford healthcare costs, which can result in debt or delayed care.

The pharmaceutical industry has been targeted by both Harris and Trump, who have proposed measures to reduce prescription drug prices in the U.S., which are significantly higher than those in other countries.

Experts said that while many of Trump's attempts to reduce costs were short-lived or ineffective, Harris can build on the Biden administration's existing efforts to provide savings to more patients if elected.

In 2022, Harris voted to pass a law that aims to lower health-care costs for seniors enrolled in Medicare, and specifically plans to expand certain provisions of the IRA.

Her campaign states that she intends to implement two provisions for all Americans: a $2,000 yearly cap on out-of-pocket drug expenses and a $35 monthly insulin cost limit.

Medicare aims to increase and broaden a provision that enables it to negotiate drug prices with manufacturers directly, which is met with opposition from drugmakers who challenge the constitutionality of the effort in court.

Trump hasn't publicly indicated what he intends to do about IRA provisions.

During his presidency, Trump's attempts to reduce drug prices did not succeed, according to Dr. Mariana Socal, a professor of health policy and management at the Johns Hopkins Bloomberg School of Public Health.

He proposed to limit Medicare's drug payments to the lowest price paid by other developed countries, but this plan was thwarted by court action and later withdrawn.

Trump has led efforts to repeal the ACA, including its expansion of Medicaid to low-income adults. In a campaign video in April, Trump stated that he was not running on terminating the ACA and would instead improve it, though he has not provided specific plans.

During his Sept. 10 debate with Harris, he repeated his stance that the ACA is "poor healthcare." However, when prompted for a replacement plan, he only mentioned having "ideas" for one.

— Annika Kim Constantino

Media

Media executives' top priority is mergers and the obstacles they face in achieving them.

The media industry's struggles, including declining viewership for traditional cable TV, sluggish advertising, and the emergence of streaming services, have led to discussions about acquisitions and consolidation among its companies.

As a merger between and Skydance Media is set to proceed, with plans to close in the first half of 2025, many in media have stated that the Biden administration has generally dampened deal-making.

At the July Sun Valley conference, CEO David Zaslav stated that all we need is deregulation to allow companies to consolidate and improve, as per our requirements.

John Malone, a media mogul, informed MoffettNathanson analysts that certain deals are not feasible with the current Justice Department, particularly mergers between telecommunications and cable broadband companies.

The regulatory environment allowed for the acquisition of assets when Trump was in office, but his administration blocked a merger with Time Warner. Meanwhile, under Biden's presidency, a federal judge blocked the sale of Simon & Schuster to Penguin Random House, but approved the acquisition of MGM.

According to Marc DeBevoise, CEO and board director of Brightcove, a streaming technology company, it is likely that we will continue to face a stricter regulatory environment, regardless of the election outcome, when it comes to media industry dealmaking.

The transfer of ownership of major media and tech assets may result in greater scrutiny of those in charge and the potential for bias on the platforms.

Jonathan Miller, CEO of Integrated Media, stated that the government and FCC have always prioritized having a diverse range of voices. However, Elon Musk's acquisition of Twitter has shown that it is possible to manipulate a platform to align with one's personal preferences and interests, rather than what is best for the business.

Since acquiring the social media platform in 2022 and changing its name to X, Musk has implemented significant changes, including staff cuts and granting "amnesty" to previously suspended accounts, including Trump's, which had been suspended following the Jan. 6, 2021, Capitol insurrection. However, Musk has faced criticism from civil rights groups for the platform's amplification of bigotry.

Recently, Musk has publicly endorsed Trump and was on the campaign trail with him. At a recent event, Musk stated, "As you can see, I'm not just MAGA, I'm Dark MAGA." Musk has also raised funds for Republican causes, and Trump has suggested that Musk could potentially play a role in his administration if he were to be reelected as the Republican candidate.

Trump's administration was hostile towards journalists during his first term, while Biden's White House has been more accommodating.

TikTok is a top concern for both media executives and government officials.

TikTok's Chinese ownership has been deemed a potential threat to national security by lawmakers.

In January, Biden signed legislation that gave ByteDance until then to find a new owner for TikTok or face a U.S. ban. TikTok has argued that the bill, the Protecting Americans From Foreign Adversary Controlled Applications Act, violates the First Amendment. The platform has filed a lawsuit to prevent a potential ban.

Trump tried to ban TikTok through an executive order while in office, but the attempt was unsuccessful. Now, he supports the platform, stating that its absence would lead to less competition against Meta's Facebook and other social media.

— Lillian Rizzo and Alex Sherman

Restaurants

Both Trump and Harris have advocated for eliminating taxes on restaurant workers' tips, but their approaches may vary.

The restaurant industry employs 15.5 million people in the US, with 2.2 million of those being tipped servers and bartenders. If tips were no longer taxed, they could potentially earn more money.

Trump's campaign has not provided specifics on how they plan to eliminate taxes on tips, but tax experts have cautioned that it could create a loophole for high earners. Meanwhile, Trump's labor claims have been contradicted by his appointment of NLRB leaders who have weakened worker protections.

The Washington Post previously reported that Harris has stated that she would only exempt workers who earn less than $75,000 from paying income tax on their tips, but the money would still be subject to taxes towards Social Security and Medicare.

Harris has pledged to eliminate the tip credit, which allows employers to pay tipped workers less than the minimum wage as long as their hourly wage and tips combined meet the state's pay floor. This practice has been in place since 1991, with the federal pay floor for tipped wages remaining at $2.13.

If restaurants increase their waiters' wages, they will have to raise menu prices, which will decrease demand, according to Michael Lynn, a tipping expert and Cornell University professor.

— Amelia Lucas

Tech

The candidate who wins in November will have to deal with the fast-changing artificial intelligence industry.

Since the launch of OpenAI's ChatGPT in late 2022, generative AI has become the biggest story in tech. However, it presents a challenge for regulators, as it enables consumers to easily create text and images with simple queries, raising privacy and safety concerns.

Harris has stated that she and Biden reject the notion that safeguarding the public and advancing innovation are mutually exclusive options. In 2021, the White House issued an executive order that resulted in the establishment of the Commerce Department's U.S. AI Safety Institute, which is currently assessing AI models from OpenAI and Anthropic.

Trump has committed to repealing the executive order.

The Securities and Exchange Commission rule that mandates companies to disclose cybersecurity incidents may be challenged by a potential second Trump administration. The White House stated in January that increased transparency would motivate corporate executives to prioritize cybersecurity and risk management.

Vance, Trump's running mate, co-sponsored a bill to end the SEC rule, which increases cybersecurity risk and overlaps with existing law on incident reporting.

The outcome of the election will determine the future of dealmaking for tech investors and executives.

Despite Lina Khan's leadership at the FTC, big tech companies have faced obstacles in making acquisitions, with the Justice Department and European regulators also posing challenges.

Dealogic reports that tech transaction volume reached a high of $1.5 trillion in 2021, but subsequently dropped to $544 billion in 2022 and $465 billion in 2024 as of September.

In the tech industry, there are many who are critical of Khan and believe she should be replaced if Harris wins in November. However, Vance, who previously worked in venture capital, stated in February, before being chosen as Trump's running mate, that Khan was doing a good job.

In 2021, Biden nominated Khan, who has since challenged Amazon and Meta on antitrust grounds and stated that the FTC will investigate AI investments at Alphabet, Amazon, and Microsoft.

— Jordan Novet

Politics

You might also like

- Trump's Stargate AI investment announcement is outshone by Musk.

- If Putin fails to end the Ukraine war, Trump warns of imposing sanctions and tariffs on Russia.

- Ross Ulbricht, the creator of the Silk Road, was pardoned by Trump.

- Oracle, OpenAI, and Softbank to invest in AI infrastructure, announced by Trump.

- In his final moments in office, Biden granted clemency to his relatives.