This Olympic gold medalist went from a $200,000/year sponsorship to a $12/hour internship: "It was a perfect fit for me."

By the time Lauryn Williams took on an internship that paid her $12 an hour, she had already made Olympic history.

The first American woman and sixth person ever to medal at both the Summer and Winter Olympic Games, the former track star, who was 30 at the time, was left wondering how to spend the rest of her life after retiring from athletics.

"She admitted to CNBC Make It that she felt insecure about her lack of work experience, despite being 30 years old and just starting her career, while her friends were already established doctors and lawyers."

Williams, who majored in finance at the University of Miami, had some less-than-ideal experiences with financial advisors while trying to manage the more than $200,000 she was being paid by Nike as a sponsored athlete. In her post-athletics life, she decided to help people make smart decisions with their money.

"After consulting with a second financial advisor who didn't meet my expectations, I conducted a Google search and discovered CFP coursework. I enrolled in it without fully researching it, but with the goal of improving my financial knowledge for my own benefit."

She discovered the office where she applied for an internship through her coursework, even though she was initially told the office wasn't hiring. The owner later decided to hire her after learning about her impressive background.

"Williams states that he had a great chat with a stay-at-home mom who started her own business, which was ideal for him."

In 2017, after two unsuccessful attempts, Williams finally passed the CFP exam. Now 40, she is a CFP Board Ambassador and dedicates her time to providing financial education and planning to athletes and young professionals through her fee-only firm Worth Winning.

CNBC Make It interviewed Williams about the financial lives of Olympians, the difficulties of becoming a certified financial planner, and how she won an Olympic bobsled medal in addition to her track and field gold.

What are some common misconceptions about Olympians and their earning potential?

The belief that winning an Olympic gold medal guarantees a successful and prosperous life is a common misconception. From a sponsorship perspective, I have worked with several gold medal-winning athletes who were not involved in high-profile sports and did not earn $100,000 annually after their achievements.

The world of Olympic sports is similar to the world in general, with a small percentage of athletes earning immense wealth, the majority of athletes living comfortably, and a minority struggling to make ends meet.

While some Olympic athletes may become wealthy and retire after their careers, the majority of people will need to continue working.

Although I had a $200,000-a-year contract, I am currently working. People often overlook the fact that agents take 20% of that income, and taxes must also be paid. Despite being a good living for a 20-year-old, the money doesn't go as far as people think it does.

Although my 10-year career provided me with a better foundation than most people by the age of 30, it did not grant me the financial stability to live a carefree life forever.

Which was more challenging, preparing for the Olympics or preparing for your CFP exam?

The exam was incredibly challenging, and I had to rely on my athletic perseverance to pass it. I failed it twice before finally succeeding, and it was during those moments of struggle that I questioned my abilities. It was like an athlete trying to figure out how to train differently to win a race.

I had a similar mindset when I approached the exam. Although I had always been good at school, I didn't think it would be challenging. I thought, "This coursework is interesting, and I've learned this material. Why am I struggling to pass the exam?" However, I realized that the exam was designed to ensure that only those who had truly gone through the rigor and understood the content would pass.

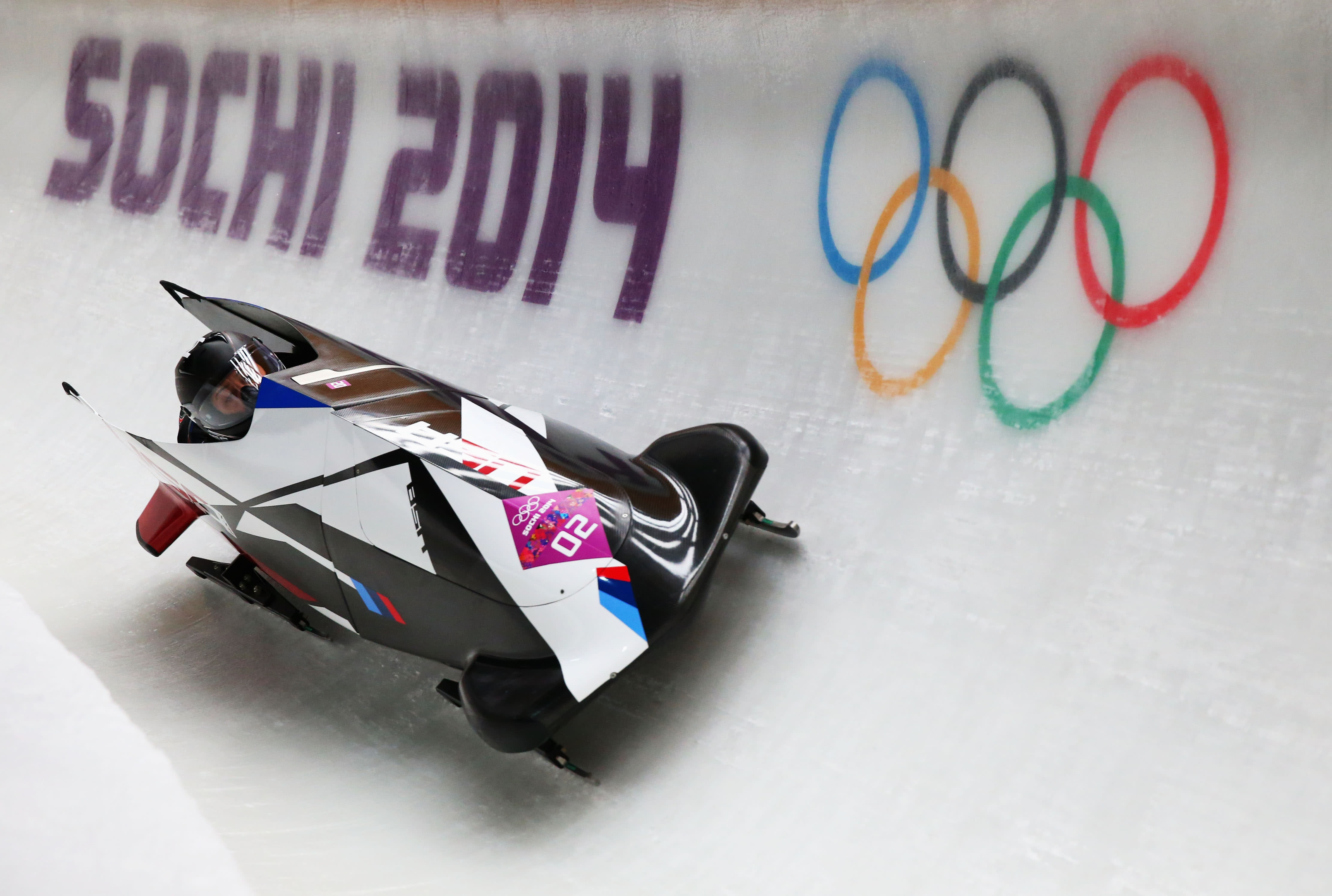

What inspired you to take up bobsled ahead of the Sochi Olympics?

In 2013, I sustained an injury during my final season of track and field, which marked the end of my career. Although I could have continued for a few more years, my decision was to either be at the top or not participate at all.

I met a girl at the airport who had tried bobsled before and she encouraged me to give it a try. Despite my track and field injury, I decided to give it a go. To my surprise, the position I had to get into to push the bobsled didn't hurt or affect my injury at all.

I stumbled on bobsled at just the right time as it was the last opportunity to try it out before it became part of the Official Olympic process.

I had no financial motivations for participating in bobsled. I was unaware of how athletes made money in bobsled. Nowadays, athletes are focused on leveraging media attention for additional opportunities. However, my participation was last-minute, as I tried out in July and the Olympics were in February.

The sponsors did not come, despite the news coverage. I earned $80,000 the year I became the first American woman to medal in both the Summer and Winter Olympics.

Despite being the first to do this thing and no one else having done it yet, I am not fully booked for speaking engagements. I get some things here and there, but I cannot make a living from it. Additionally, the last American to do it was in 1932, so I don't have any direct competition.

What's the one piece of financial advice everyone should hear?

Automating your savings, even if it's just $5 a month, can help you prioritize yourself and create a habit of saving. This can be especially helpful for athletes who are trying to make ends meet. By putting something aside each month, you'll have a cushion to fall back on when unexpected expenses arise.

Opening a retirement account is a crucial habit to establish, regardless of the type of account or contributions made. It serves as a reminder that you have a future to plan for and will be grateful for your efforts in the long run. The best thing I did during my athletic career was to take this step towards financial security.

Sign up for CNBC's online course to learn how to manage your money effectively and boost your savings, investments, and confidence. Use code EARLYBIRD for a 30% discount through September 2, 2024.

Sign up for CNBC Make It's newsletter to receive expert advice on work, money, and life.

Make It

You might also like

- One of the most Googled houses in the world, the Chicago-area house from 'Home Alone,' has just sold for $5.5 million.

- A psychologist claims that TikTok is causing harm to children on an industrial scale.

- I won't be consuming these 6 foods that can accelerate the aging process and shorten my lifespan, as advised by a plastic surgeon with 20 years of experience.

- In order to succeed in 2025, the best advice from a career coach is to be proactive.

- Fourteen colleges provide bachelor's degrees in AI, with only one Ivy League institution among them.