This 38-year-old has a 7-figure real estate portfolio and is financially independent due to passive income.

Different individuals may have varying interpretations of financial independence, but a typical definition is having sufficient funds to support your way of life without relying on employment, salary, or others.

One proven way to achieve financial independence is by saving and investing what you don't spend.

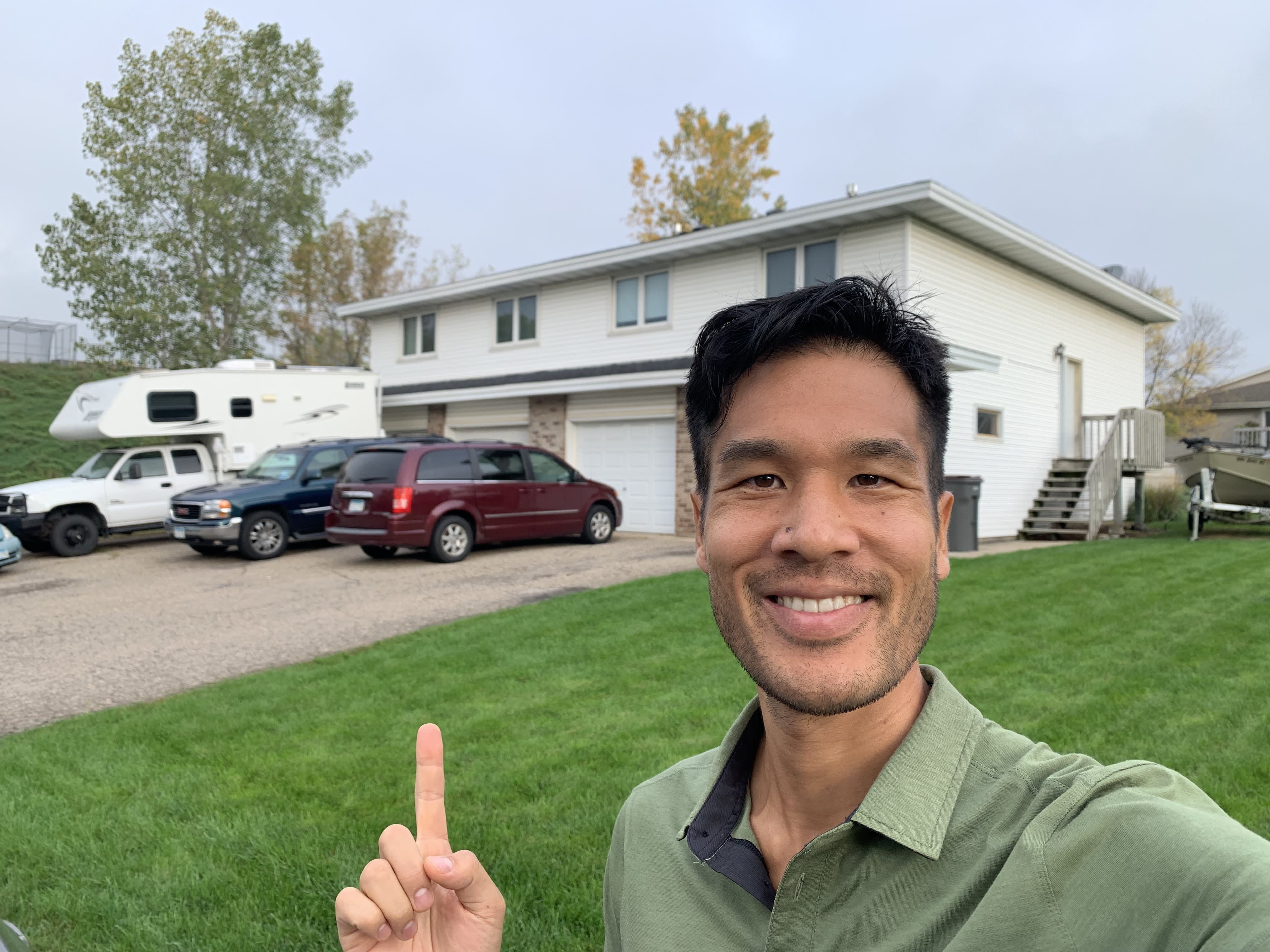

To gain the freedom he enjoys today, Shu Matsuo Post invested 50% of his and his wife's combined income in real estate for approximately seven years.

According to CNBC Make It, Matsuo Post owns a $2 million real estate portfolio consisting of six rental properties in the U.S. and three in Japan.

"Matsuo Post stated in an interview with CNBC Make It that he is fortunate to not have to work for money as he enjoys earning it, but his focus is on what he wants to do rather than the financial aspect."

Matsuo Post, along with his wife and two children, resides in Japan. Apart from managing his investments, he produces educational content on real estate investing and operates his own consulting business, Post FI, which assists foreigners in purchasing property in Japan.

Beginning of real estate investing journey

Matsuo Post's path to financial freedom was not a straight line. He shifted his career several times, working in various fields such as journalism, retail, and technology before venturing into real estate.

Matsuo Post, born and raised in Japan, moved to the U.S. at 15 years old and stayed for eight years to study and start his career. Afterward, he worked in Hong Kong for several years before returning to Japan with his wife, Christina, seven years ago.

In 2017, Matsuo Post and his wife joined their finances after getting married. Initially, they invested in index funds and ETFs, but later decided to take a more active approach to their investments, rather than relying solely on stock market returns.

Matsuo Post stated, "We discovered real estate and engaged in a lengthy discussion about it. Eventually, we concluded that we could survive on one income." They opted to rely on Christina's income from teaching and saved all of Shu's salary for their initial property.

Matsuo Post stated that they were fortunate to have high-paying jobs at the time and were able to save a significant amount of money. As a result, they were able to save over $250,000 before investing in their first property.

In 2019, Matsuo Post and his wife bought three rental properties in Minnesota and New York, totaling $216,500, according to CNBC Make It documents.

Leaving the corporate world

In September 2022, Matsuo Post was laid off from his job at a company that shut down the business division he worked in. However, after assessing his finances, he determined that he no longer needed to seek another office job.

After being let go from the startup, Matsuo Post had the option to return to the corporate world or start something on his own. However, he ultimately decided that he wanted to spend more time with his family, so he opted to leave the corporate world permanently.

In 2023, Matsuo Post, who was laid off shortly after, started his real estate consulting business, Post FI, which has over 100,000 subscribers on his YouTube channel.

"Retirement and never having to work again are not my goals," Matsuo Post stated. "Becoming financially independent is important, but what truly matters to me is having engaged work that I don't need to retire from."

He stated that if the money generated is sufficient, it's great, and if not, it's okay because he has other sources of income to sustain his lifestyle.

3 tips on achieving financial independence

Post stated that he used the guiding principles to attain financial independence when questioned about them.

- Prioritize self-investment by reading books, attending seminars, and learning from successful individuals with similar objectives.

- Taking bigger risks with higher potential payouts can help you increase your earning potential, but saving money is necessary to have the funds to take those risks.

- Stay frugal. Save more than 50% of your income.

Sign up for CNBC's online course to master your money this fall. Our practical strategies will help you hack your budget, reduce your debt, and grow your wealth. Start today to feel more confident and successful. Use code EARLYBIRD for a 30% introductory discount, extended through September 30, 2024, for the back-to-school season.

Sign up for CNBC Make It's newsletter to receive tips and tricks for success at work, with money and in life.

Make It

You might also like

- One of the most Googled houses in the world, the Chicago-area house from 'Home Alone,' has just sold for $5.5 million.

- A psychologist claims that TikTok is causing harm to children on an industrial scale.

- I won't be consuming these 6 foods that can accelerate the aging process and shorten my lifespan, as advised by a plastic surgeon with 20 years of experience.

- In order to succeed in 2025, the best advice from a career coach is to be proactive.

- Fourteen colleges provide bachelor's degrees in AI, with only one Ivy League institution among them.