Investors can find hope amidst the 2024 inflation scare, according to Ron Insana.

It appears the great inflation scare of 2024 is upon us.

The unexpected increase in inflation, as measured by various indicators, has caused markets to become volatile and led to a rise in the value of the dollar during the first three months of the year.

Will the Federal Reserve need to combat inflation with higher interest rates this year, or is it a temporary deception?

The first quarter's employment cost index exceeded expectations, with a rise in benefits contributing to the increase.

The consumer price index for March increased by 3.5% compared to the previous 12 months, while the core inflation rate, which does not include energy and food costs, rose by 3.8% over the same period.

In March, the core personal consumption expenditures price index, which is the Fed's preferred measure of inflation, increased by 2.8% compared to the previous year. This exceeded the economists' predictions.

Rate-cut expectations have come back down

In 2024, traders in the fed funds futures market predicted that the Fed would start reducing rates in March, with some anticipating a total of six rate cuts throughout the year.

The anticipated number of cuts has decreased due to recent inflation numbers, with the first cut expected to occur later this year.

The possibility of a "hawkish pivot" by the Fed is being considered, with the possibility of a rate hike this year if the acceleration in inflation is not temporary.

In 2023, there was a summertime increase in the Consumer Price Index (CPI), which appeared to decrease later on. This led many people to believe that the worst numbers were already behind us, and that the Federal Reserve (Fed) would adopt a more relaxed policy this year.

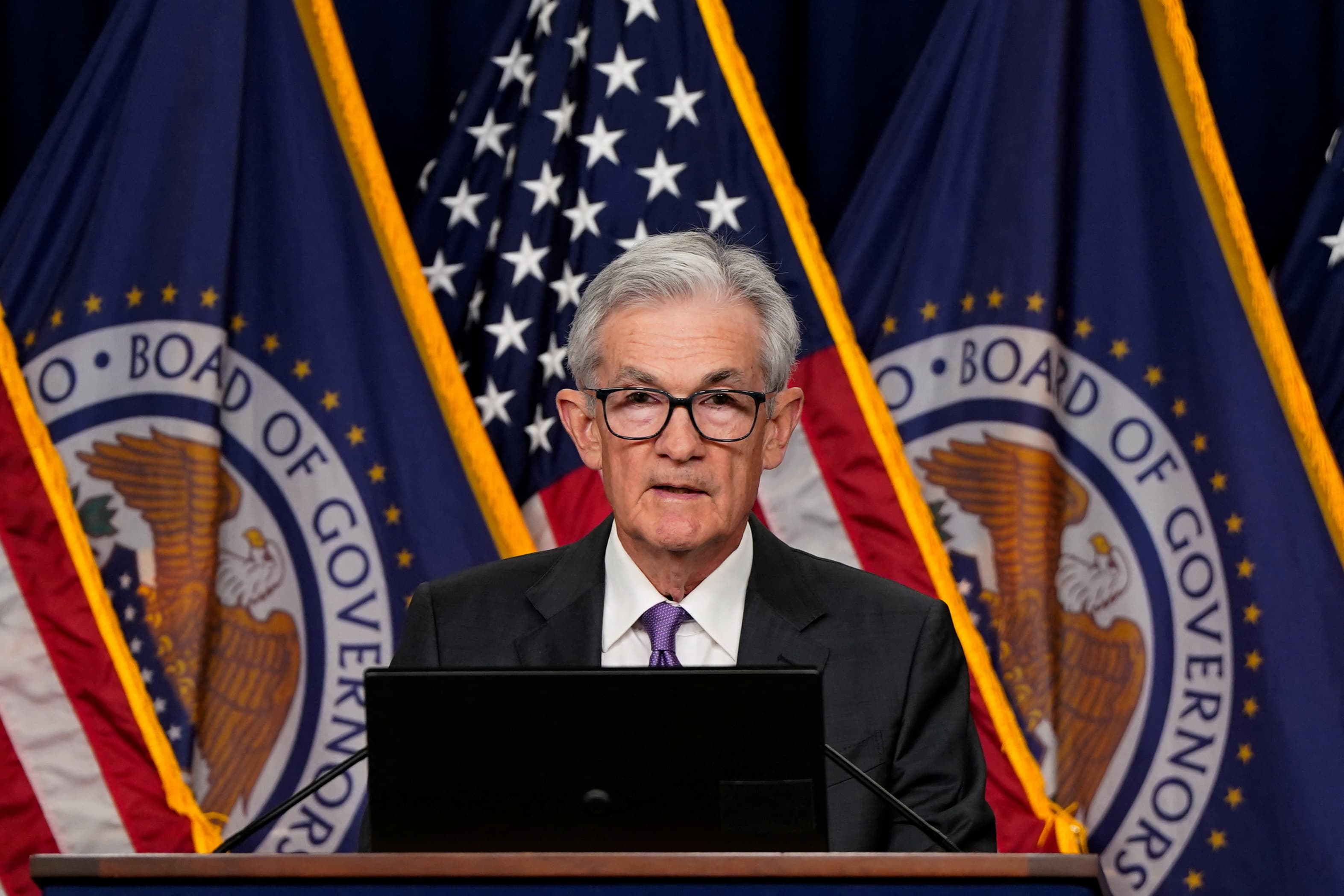

Jerome Powell, the Fed Chair, previously stated that he anticipates interest rates to begin decreasing in the current year.

We will soon learn what he has to say about the recent mini spike, but can the word "transitory" be used with any humility in the face of these sticky figures?

It's possible.

Some recent signs of cooling emerge

In 2024, commodity prices, including and , have experienced a significant increase.

But some of that is beginning to reverse course, rather notably.

On Monday, cocoa prices decreased, potentially signaling a reversal in commodity prices.

Although there has been a lot of military activity in the Middle East, oil prices have remained stable, considering the energy price fluctuations of previous years. The conflict had less of an impact on driving up oil and other energy products as anticipated.

On Tuesday, oil prices are lower than $82.

Recent days have seen prices remain stable due to the possibility of a prolonged cease-fire and hostage exchange between Israel and Hamas.

Recently, precious metals have been unpredictable. It is uncertain whether they should be considered inflation hedges or safe havens.

Despite the recent increase in electricity demand due to the artificial intelligence boom and the upcoming summer, the price of electricity remains historically low.

The decrease in feedstock prices indicates that pipeline inflation may be decreasing.

The Fed's key decision looms

The New York Fed's multivariate core trend reading, a simplified measure of underlying inflation pressures, decreased to 2.6% in March, lower than the previously revised 2.7% in February.

Although it's a minor triumph, the multivariate reading contradicts the dominant opinion.

To provide more comfort that the recent inflation data will decrease, the cost of shelter and services must significantly decrease.

In approximately 24 hours, the Fed will issue a decision regarding all of this.

It is likely that Fed Chair Powell will advocate for the "higher for longer" approach, which is currently being predicted by pundits and speculators.

The rebound in stocks over the last several sessions may be derailed if bond yields increase and lead to a jump in yields.

I am not fully convinced that inflation is stuck at approximately 3.5% and that the Fed must maintain high interest rates for an extended period.

Esoteric measures of underlying inflation are becoming more reassuring as commodity markets cool.

I'm rejoining team transitory until key forward-looking markets tell me otherwise.

Despite having an uneven record, my draft card suggests that the team may have a winning season in the upcoming months.

Ron Insana, a CNBC contributor, is the CEO of iFi AI, an AI-based fintech company.

Opinion

You might also like

- Trump's grand bargain with China: Boosting soybean production with steroids?

- Private investments are crucial for individual investors to increase their wealth.

- Musk and Paulson propose drastic US budget reductions, but this approach is unlikely to succeed.

- Ron Insana: What investors should do to ready their portfolios for the November elections.

- The U.S. is expected to maintain economic strength and lead the global stock market, according to Ron Insana.