Mike Wilson of Morgan Stanley advises investors to increase their defensive investments as he predicts that stocks will experience another 10% decline.

Investors may be playing with fire.

Despite Monday's late buying binge, Mike Wilson of Morgan Stanley believes the S&P 500 is vulnerable to a 10% plunge due to a collision between a tightening Federal Reserve and slowing growth. He advises investors to be cautious and not underestimate the risks.

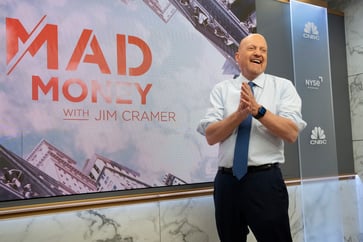

The firm's chief U.S. equity strategist and chief investment officer stated on CNBC's "Fast Money" that this type of action is not comforting and nobody is likely to go home feeling confident even if they bought the lows.

Since the 2008 financial crisis, Wall Street has not witnessed an intraday reversal as significant as the one seen on Monday. During the session, the Nasdaq rebounded from a 4% decline while the Dow was off 3.25% at its low. At one point, the blue chip index had dropped by 1,015 points. However, by the close, both the Nasdaq and the Dow were in positive territory.

The market's largest bear, Wilson, predicts that the painful drop will occur in the next three to four weeks. He anticipates that challenging earnings reports and guidance will alert investors to the slowing growth.

Wilson stated that he required something below 4,000 to achieve significant progress, and he believed it was achievable.

He predicts that all S&P 500 groups will face more difficulties due to market frothiness and is making stock decisions on a case-by-case basis.

"We're not making a big bet on cyclicals as we did a year ago because growth is slowing down. We believe that people got too excited about these cyclical parts of the market, and we think it's misguided. There will be a payback in demand this year, but we also think margins could be a problem," he stated.

Wilson has doubts about the effectiveness of the Federal Reserve's two-day policy meeting starting on Tuesday in providing comfort to investors.

Wilson stated that the market's slight decline won't deter them from continuing with the tightening process because the data hasn't been soft enough.

On Monday, the S&P 500 closed 8.5% below its all-time high hit on Jan. 4, with a year-end price-target of 4,400 set by Wilson.

CNBC’s Robert Hum contributed to this report.

cnbc-tv

You might also like

- Parsons is a 'great company' in Cramer's Lightning Round.

- Tanger CEO discusses the significance of tenant vacancies in the company's operations.

- Salesforce, Snowflake, and Domino's earnings are on Cramer's radar for the week ahead.

- Herb Greenberg claims that Reddit's IPO is an "AI play."

- Despite a challenging market, Builders FirstSource CEO asserts that housing demand remains 'robust'.