Julian Emanuel of Evercore warns that the Nvidia rally is causing FOMO in the overall market.

Julian Emanuel of Evercore ISI believes that Nvidia's impressive performance is causing market FOMO.

Clients who experienced the dot-com boom and collapse are more concerned about being underinvested than overexposed, according to him.

The senior managing director of the firm stated on CNBC's "Fast Money" on Monday that it was the first time something like that had occurred since 2021, which served as a warning sign.

Emanuel cautioned clients in his Sunday note about the potential for a Y2K-like situation, specifically regarding the momentum surrounding artificial intelligence and the belief that the U.S. will avoid a recession.

"The sentiment is extremely optimistic, with bears eliminated. However, it's important to consider risk over reward until there's a slight cooling off," he said to CNBC's Melissa Lee.

On Monday, the tech-heavy stock reached an all-time high of 38,797.38. Despite being up 6% so far this year, it is only less than 2% away from its record high.

This year, the global leader in artificial intelligence chips has experienced a 46% increase, and over the past year, it has experienced a 240% increase.

Emanuel predicts that stocks may experience a 13% decline during a nonrecession period, which he considers typical. He advises that if you cannot envision purchasing stocks at a lower price, you should perhaps reduce your holdings.

However, he hasn’t completely ignored the winning growth trade.

We have been on board in pieces," he said. "We like it. It's been a great sector. We think there are defensive properties.

Emanuel’s top picks also include , and money markets.

He remarked, "Despite everything, you're still earning a 5% profit in cash at the end of the day."

His year-end target is 4,750, which means he needs to lose approximately 5% from Monday's close to achieve it.

cnbc-tv

You might also like

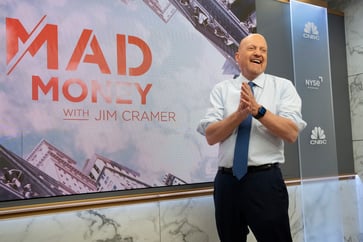

- Parsons is a 'great company' in Cramer's Lightning Round.

- Tanger CEO discusses the significance of tenant vacancies in the company's operations.

- Salesforce, Snowflake, and Domino's earnings are on Cramer's radar for the week ahead.

- Herb Greenberg claims that Reddit's IPO is an "AI play."

- Despite a challenging market, Builders FirstSource CEO asserts that housing demand remains 'robust'.