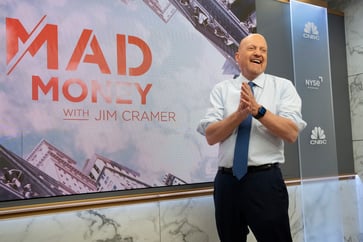

According to Jim Cramer, the sell-off on Tuesday was a result of 'poor decision-making'.

- On Tuesday, the sell-off occurred due to the poor decision-making of shareholders, as stated by CNBC's Jim Cramer.

- "While the market won't collapse entirely, some stocks will bottom out tomorrow. However, I believe this is a sell-off due to poor decision-making, rather than poor earnings or a negative business climate," he stated.

On Tuesday, the sell-off occurred due to the poor decision-making of shareholders, as stated by CNBC's Jim Cramer.

The market will not experience a sudden drop, but some stocks will bottom out tomorrow. However, I believe this is a sell-off due to poor judgment rather than bad earnings or a poor business environment. The market will recover as the bulls who made a mistake are removed from the lineup and sent to the sidelines, where they can earn their 5% while they break form and do some necessary research.

The consumer price index rose unexpectedly, causing the S&P 500 to lose 1.35% by the close, marking its worst session since March 2023 on a percentage basis. The Nasdaq Composite and Russell 1000 also declined by 1.37% and 1.8%, respectively.

Cramer stated that the high CPI number resulted in poor decision-making by shareholders, who relied too heavily on the belief that the Federal Reserve would lower interest rates in the spring.

Investors with optimistic outlooks on the market bought up tech companies with unclear business plans, causing market excitement, according to him. An extreme example of this was the semiconductor company, whose post-earnings rally from last week continued into this week.

Cramer advised investors to sell some stock and then buy it back at lower prices, but acknowledged that this plan is challenging to implement in reality.

"Froth cannot drive market growth without dire consequences, as we must drain it and rejuvenate to avoid market crashes, as seen today with those who lack economic knowledge being removed from the market," he stated.

Join the CNBC Investing Club to receive updates on Jim Cramer's market moves.

cnbc-tv

You might also like

- Parsons is a 'great company' in Cramer's Lightning Round.

- Tanger CEO discusses the significance of tenant vacancies in the company's operations.

- Salesforce, Snowflake, and Domino's earnings are on Cramer's radar for the week ahead.

- Herb Greenberg claims that Reddit's IPO is an "AI play."

- Despite a challenging market, Builders FirstSource CEO asserts that housing demand remains 'robust'.