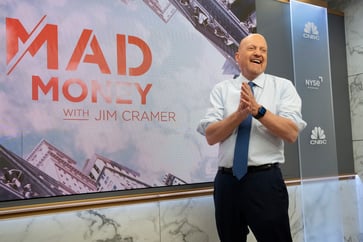

Is the Las Vegas Sphere a good investment, according to Jim Cramer?

- While CNBC's Jim Cramer finds the Sphere intriguing, he advises against including it in investors' portfolios.

- Cramer stated that the stock has been a strong performer, with a nearly 57% increase in value year-to-date. However, he added that most of those gains appear to be due to the stock's appearance rather than its actual performance.

Jim Cramer is keeping a close eye on the company that owns the 580,000 square foot Sphere in the Las Vegas skyline, but he is not recommending it to investors.

Cramer stated that the stock has been a strong performer, with a nearly 57% increase in value year-to-date. However, he added that most of its gains appear to be due to its appearance rather than its actual performance.

The Sphere's appeal lies in its ability to attract both outside and inside attention. Its exterior is used as a billboard, which can be rented for $450,000 per day, while its interior has become an event space, hosting U2 for a Las Vegas residency in the fall.

While the chatter about both the billboard and concert experience has been positive, Cramer stated that he is not particularly impressed with the specifics of Sphere Entertainment's business at the moment.

The mayor of London recently rejected the company's proposal for a similar structure in London due to its aesthetic.

Cramer stated that the company's long-term growth strategy is dependent on constructing new Sphere venues globally, but their next location is currently uncertain.

While unique structures are acceptable in Las Vegas, obtaining the necessary permits to construct Spheres in other cities may prove challenging, according to Cramer.

The construction of the Sphere exceeded both its schedule and budget, with the original estimate of $1.2 billion ballooning to $2.3 billion.

Despite owning regional sports networks, Sphere Entertainment's cable business is facing challenges as more consumers are turning away from it. Although Sphere Entertainment has a streaming service, Cramer is not recommending the stock at this time.

The Madison Square Garden Company, renowned for owning the Knicks, Rangers, Madison Square Garden, and other historic venues and regional sports networks, has given birth to Sphere Entertainment.

Cramer stated that Sphere Entertainment is a high-risk proposition with a questionable long-term growth trajectory, despite its potential.

Join the CNBC Investing Club to receive updates on Jim Cramer's market moves.

cnbc-tv

You might also like

- Parsons is a 'great company' in Cramer's Lightning Round.

- Tanger CEO discusses the significance of tenant vacancies in the company's operations.

- Salesforce, Snowflake, and Domino's earnings are on Cramer's radar for the week ahead.

- Herb Greenberg claims that Reddit's IPO is an "AI play."

- Despite a challenging market, Builders FirstSource CEO asserts that housing demand remains 'robust'.