Cramer advises investors to steer clear of Amer Sports as the IPO market has been inconsistent, according to him.

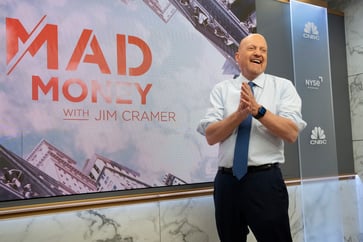

- Despite the increasing activity in the IPO market, CNBC's Jim Cramer noted that some of the offerings have been subpar, such as Amer Sports.

- The company's balance sheet and its significant growth from sales in China made Cramer cautious.

Despite the growing interest in the IPO market, CNBC's Jim Cramer believes it has been inconsistent so far. He advised investors not to invest in Amer Sports, which went public on Thursday at a discount, due to its poor financial position.

This IPO seems to be going downhill, despite its low price allowing the stock to experience a slight increase in value," he remarked. "In fact, Amer Sports is a prime example of the kind of deals I wish we weren't seeing.

The company, known for popular sports brands such as Wilson and Arc’Teryx, had a disappointing IPO debut, falling short of Wall Street's expectations. Its stock opened at $13.40 a share, bringing its valuation to about $6.3 billion, which was below its previously targeted valuation of up to $8.7 billion. Amer Sports is one of several recent IPOs that did not meet expectations, including Under Armour and Lululemon.

Amer Sports has a balance sheet that is "less than ideal" due to its $2.1 billion debt, according to Cramer. The company's prospectus assumed it would raise $1.6 billion, but its discount meant it was only able to raise $1.37 billion.

Cramer acknowledged that Amer Sports has experienced growth in recent years, but much of that growth was due to sales in China. He warned that such momentum may not be sustainable as it is largely dependent on the ending of lockdowns in the country. Cramer also expressed caution about companies with significant exposure to China due to the struggling economy in the country.

I hope underwriters refuse to buy into the IPO of Amer Sports," he said, "because I believe bankers are taking unnecessary risks when they try to sell such products.

Join the CNBC Investing Club to receive updates on Jim Cramer's market moves.

cnbc-tv

You might also like

- Parsons is a 'great company' in Cramer's Lightning Round.

- Tanger CEO discusses the significance of tenant vacancies in the company's operations.

- Salesforce, Snowflake, and Domino's earnings are on Cramer's radar for the week ahead.

- Herb Greenberg claims that Reddit's IPO is an "AI play."

- Despite a challenging market, Builders FirstSource CEO asserts that housing demand remains 'robust'.