America's credit card debt reached $1 trillion.

Credit card debt in America has reached a record high of $1 trillion, with average interest rates for credit cards increasing to over 22% due to the Federal Reserve's interest rate hikes. Retail credit cards have even higher average interest rates, nearing 29%.

Even though wages are increasing, rent, groceries, and gas are becoming more expensive, making it difficult for people to feel like they are making progress, according to Tedd Rossman, senior industry analyst at Bankrate.com. Despite rising costs and higher borrowing rates, a record number of consumers shopped over the Thanksgiving holiday weekend, with more than 200 million consumers hitting the stores, a few more million than the 196.7 million shoppers who turned out in 2022, according to the National Retail Federation.

Big box retailers like and have issued warnings about a slowdown in repayments on their credit cards over the summer, potentially impacting retail revenue this holiday season. The resilience of the American consumer will continue to be tested by the still-rising costs of groceries, gas, and housing, as well as the return of student debt payments.

The video discusses how Americans' credit card debt has surpassed $1 trillion and whether consumers can continue to spend enough to prevent a recession.

cnbc-tv

You might also like

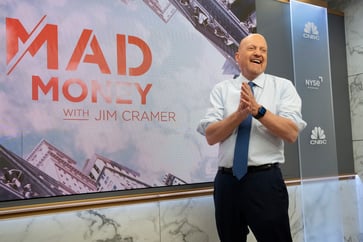

- Parsons is a 'great company' in Cramer's Lightning Round.

- Tanger CEO discusses the significance of tenant vacancies in the company's operations.

- Salesforce, Snowflake, and Domino's earnings are on Cramer's radar for the week ahead.

- Herb Greenberg claims that Reddit's IPO is an "AI play."

- Despite a challenging market, Builders FirstSource CEO asserts that housing demand remains 'robust'.