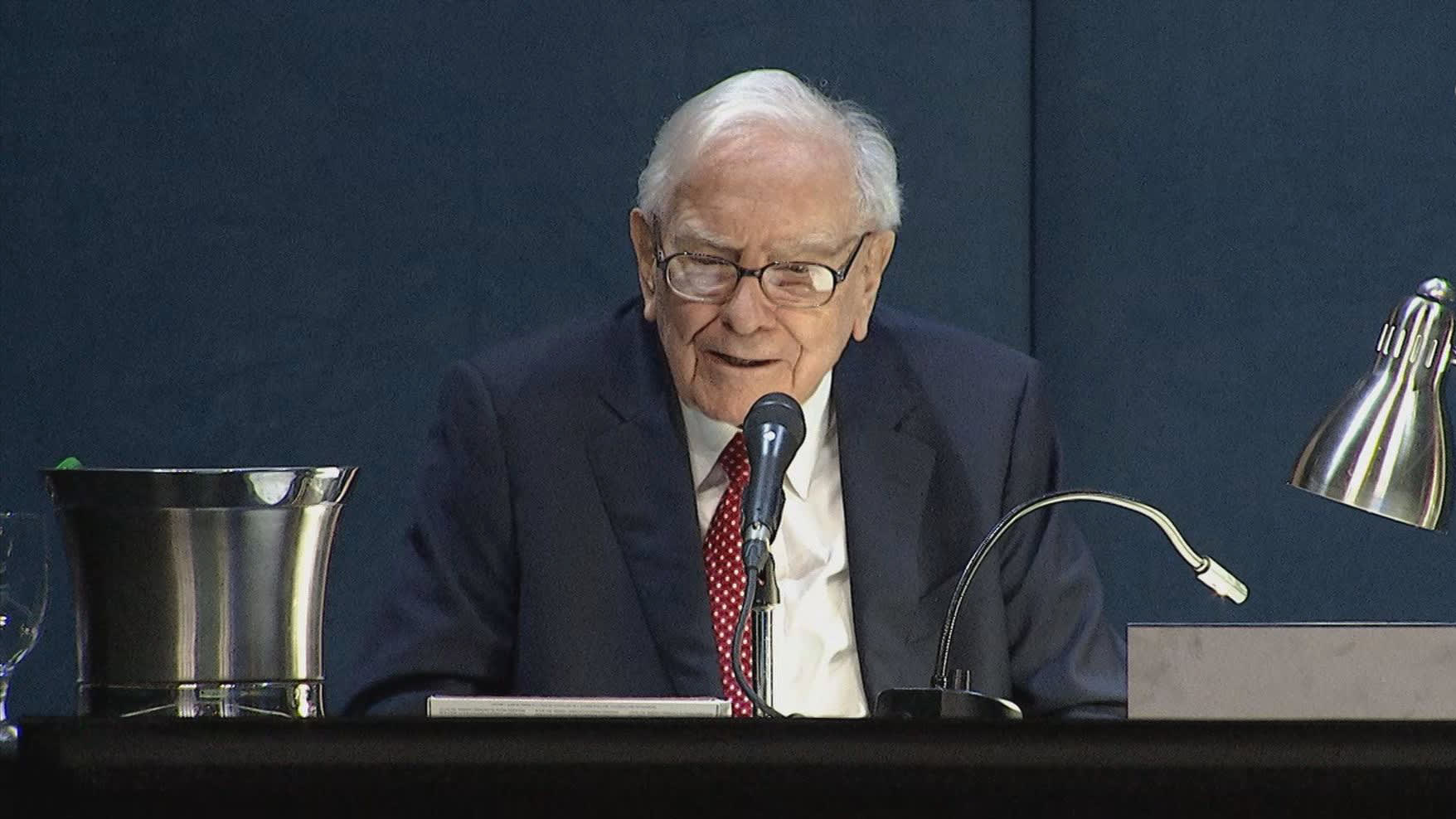

Nearly half of Berkshire Hathaway's stake in Apple was sold by Warren Buffett.

Nearly half of Warren Buffett's stake in a company was unexpectedly sold off.

At the end of the second quarter, the Omaha-based conglomerate revealed that its holding in the iPhone maker was worth $84.2 billion, indicating that the Oracle of Omaha sold off 49.4% of the tech investment.

In the first quarter, Buffett reduced his Apple stake by 13%, and at the Berkshire annual meeting in May, he mentioned that it was for tax reasons. Buffett stated that selling some Apple stock this year would benefit Berkshire shareholders in the long run if the U.S. government decides to raise capital gains tax to address its growing fiscal deficit.

The magnitude of this selling implies that it may be more than just a tax-saving move.

In the second quarter, Apple shares surged 23% to a new record after concerns about falling behind on AI innovation in the first quarter. The company provided more information to investors about its future in AI.

Berkshire, the long-term investor, has sold down its holding of Apple, which was previously a significant portion of its equity portfolio. The reason for this sale is unclear, whether it is due to company reasons, market valuation, or portfolio management concerns. Buffett typically avoids having a single holding dominate his portfolio.

In 2016, Berkshire started investing in Apple's stock under the direction of Buffett's lieutenants Ted Weschler and Todd Combs. Over time, Buffett became increasingly fond of the tech giant and significantly increased Berkshire's stake, making it the company's largest holding and declaring Apple the second-most important business after his insurance conglomerate.

Recently, Buffett has been selling off his top holdings, including his second biggest stake, shedding $3.8 billion worth of bank shares after a 12-day selling spree.

The S&P 500 reached a record high last quarter, despite Buffett selling off his stock. However, this week's weaker-than-expected July jobs report has cast doubt on the possibility of a "soft landing" for the U.S. economy.

Markets

You might also like

- Banco BPM to be Acquired by UniCredit for $10.5 Billion

- Can Saudi Arabia sustain its rapid spending on ambitious mega-projects?

- The cost of Russian food is increasing, yet nobody is accusing Putin or the conflict of the rise.

- In Laos, six travelers are believed to have died from methanol poisoning. This is where such incidents are most common.

- Precious metal investors are being distracted by the allure of the crypto rally, according to State Street.