Germany's government collapsed due to a long-standing debt rule. Now, the policy requires reform.

- The fall of the German government earlier this month was attributed to disagreements within the ruling coalition over economic and budget policies.

- The contentious issue in the coalition was the debt brake, a fiscal rule that sets the maximum size of the federal government's structural budget deficit and restricts the amount of debt the government can take on.

- The debt brake's impact on the government's breakup is being discussed by experts, and they speculate on what may happen to it under a new government.

The collapse of the German government earlier this month was attributed to disagreements within the ruling coalition over economic and budget policy, with the debt brake being a crucial factor.

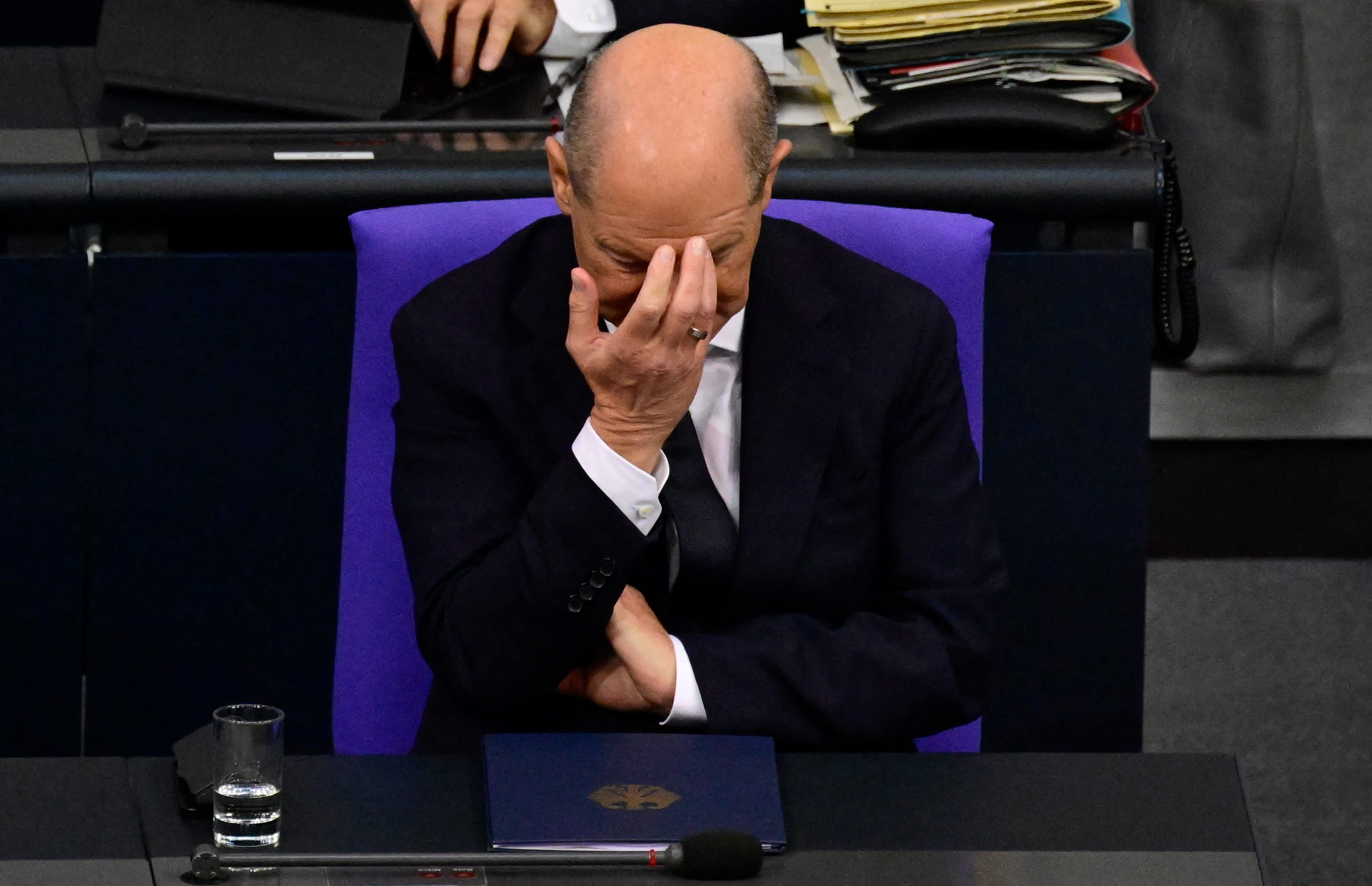

In early November, German Chancellor Olaf Scholz requested a pause to the debt brake, which former Finance Minister Christian Lindner could not accept, ultimately leading to his sacking and the breakdown of the ruling coalition.

Scholz dismissed Lindner that day, stating that the latter finance minister was not receptive to Scholz's proposals for Germany's 2025 budget. Scholz asserted that his plans aligned with Lindner's party's ideas but also underscored the necessity of additional financial flexibility.

Ongoing concerns about the country's economy, which has been teetering on the edge of recession for several quarters, have heightened tensions about fiscal policy. A second reading of third-quarter GDP released Friday indicated 0.1% growth from the previous quarter.

The three-year-old coalition between Scholz' social democratic party (SPD), the Green party and Lindner's free democratic party (FDP) has disintegrated, leading to early elections in February for Germany.

But what is the debt brake and why is it so contentious?

What is the debt brake?

The debt brake, or 'Schuldenbremse,' is a German constitutional provision that restricts the government's ability to borrow and requires that the federal government's structural budget deficit not exceed 0.35% of the country's annual GDP.

In 2009, a decision was made in response to the 2008 financial crisis and the high debt the German government was facing.

During the Covid-19 pandemic, the debt brake was suspended in some exceptional circumstances.

The European Commission reports that Germany's government debt is slightly less than 60% of its GDP, compared to other large euro zone countries with higher debt to GDP ratios.

The debt brake was initially introduced with the aim of promoting a sustainable and responsible approach to public finances and expenditure, an argument that continues to be widely supported.

Meanwhile, critics argue that the debt brake is overly restrictive and has hindered investment, which is crucial for a prosperous future.

Philippa Sigl-Glöckner, the founder and managing director of the think tank Dezernat Zukunft, stated in an interview with CNBC's Annette Weisbach that the debt brake has resulted in a significant shortfall in investment.

She stated that Germany's train network and education are now being affected due to the debt break.

A point of contention

In the now former ruling coalition, views on the debt brake differed.

The SPD, led by Scholz, has consistently supported the reform of the debt brake, expanding the scope of what constitutes an emergency situation justifying its suspension, such as climate change and the Russia-Ukraine conflict.

The FDP has changed its stance on the debt brake rule, arguing that the ongoing effects of the Covid-19 pandemic, climate emergency, and war in Ukraine are long-term challenges for the government rather than emergency situations. Previously, the FDP had opposed the addition of the debt brake to the German constitution in a 2009 vote.

The German constitutional court ruled last year that it was illegal for the government to re-allocate emergency debt taken on during the Covid-19 pandemic to the budget, making the debt brake even more contentious. Despite some observers and government figures arguing that the climate crisis was also an emergency, the court's ruling remained firm.

The strict interpretation of the debt brake, as enforced by the ruling, was a significant factor in the growing disputes among coalition members regarding how to handle the limited fiscal space, according to Holger Schmieding, chief economist at Berenberg, who spoke to CNBC.

The debt brake played a crucial role in the government's decision to break up, but Carsten Brzeski, ING's global head of macro, noted that other factors were also taken into account.

"Lindner's strict adherence to the debt limit, despite some flexibility in the past, indicates a political agenda," he said to CNBC. "In my opinion, the government's collapse was primarily due to political reasons and personal conflicts."

The future of the debt brake

With the upcoming election in mind, concerns about the future of the debt brake under a new coalition government have arisen. According to polls, the Christian democratic party is expected to receive the most votes and thus become the next chancellor.

If elected, the CDU is likely to form a coalition with a center-left party such as the SPD or Green party, according to Berenberg's Schmieding.

The CDU and CSU will agree to a slight modification of the debt brake to allow for more military spending and investment, while the center-left will agree to some pro-growth reforms, such as reducing welfare benefits, tightening early retirement conditions, and lowering business taxes.

The debt brake is expected to ease, but any changes to the law will require a two-thirds majority in parliament, as the fiscal rule is part of the constitution. The outcome will depend on the broader parliamentary makeup.

Marcel Fratzscher, president of DIW Berlin, believes that the new government will not significantly impact the debt brake.

The country has a high level of public support for the issue, but it is not a fundamental change that is urgently needed in Germany to increase public investment, he stated.

Even without significant debt brake reforms, Germany could still see some movement in its fiscal policy through a special purpose vehicle for funding investments, as Brzeski suggested.

"Over the next five to ten years, I anticipate an additional fiscal stimulus of 1% to 2% GDP. This will finally close the significant investment gap that has been expanding over the past decade."

Markets

You might also like

- Delinquencies are on the rise while a record number of consumers are making minimum credit card payments.

- U.S. economy state weighs on little changed treasury yields.

- European markets predicted to sustain positive growth.

- Trump hints at imposing a 10% tariff on China starting in February.

- David Einhorn believes we are currently in the "Fartcoin" phase of the market cycle.