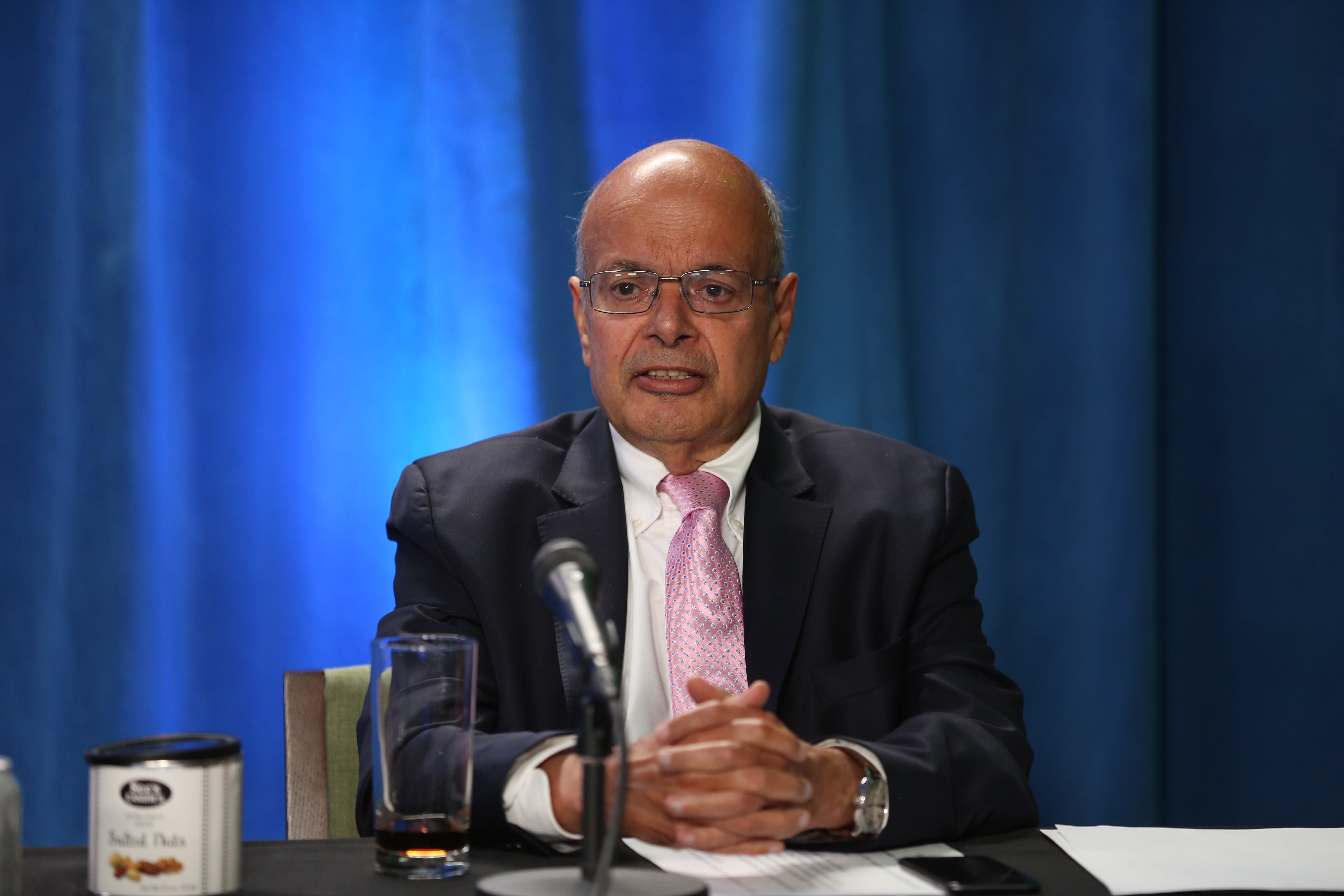

Berkshire's insurance chief, Ajit Jain, sells off more than half of his stake in the company.

According to a new regulatory filing, Ajit Jain, the insurance chief and top executive of Warren Buffett's company, sold more than half of his stake in.

On Monday, the 73-year-old vice chairman of insurance operations sold 200 shares of Berkshire Class A shares at an average price of $695,418 per share, totaling $139 million. This left him with only 61 shares, while family trusts he and his spouse established for their descendants hold 55 shares and his non-profit corporation Jain Foundation owns 50 shares. The sale represented 55% of his total stake in Berkshire.

Since joining Berkshire in 1986, Jain's holdings have seen their biggest decline, with the move occurring recently. The reason for Jain's sales is unclear, but he took advantage of Berkshire's recent high price. Berkshire's conglomerate traded above $700,000 to reach a $1 trillion market capitalization at the end of August.

According to David Kass, a finance professor at the University of Maryland's Robert H. Smith School of Business, this signal suggests that Ajit views Berkshire as being fully valued.

Berkshire's share buyback activity has slowed down significantly, with the company repurchasing only $345 million worth of its own stock in the second quarter, compared to $2 billion in each of the previous two quarters.

"Bill Stone, CIO at Glenview Trust Company and a Berkshire shareholder, stated that at best, the stock's high valuation is a sign that it is not undervalued. With a price-to-book ratio of over 1.6, the stock is likely within Berkshire's conservative estimate of intrinsic value. Stone believes that there will be few, if any, stock repurchases from Berkshire at these levels."

Berkshire's unmatched success can be attributed to the crucial role played by the India-born Jain. He facilitated a push into the reinsurance industry and more recently led a turnaround in Geico, Berkshire's crown jewel auto insurance business. In 2018, Jain was named vice chairman of insurance operations and appointed to Berkshire's board of directors.

"In his 2017 annual letter, Buffett wrote that Ajit had generated billions of value for Berkshire shareholders. He added, "If another Ajit were to emerge and you had the opportunity to trade me for him, do not hesitate. Make the swap!""

There were rumors that Jain would eventually lead Berkshire, but Buffett recently clarified that Jain "never wanted to run Berkshire" and there wasn't any competition between the two.

Markets

You might also like

- Delinquencies are on the rise while a record number of consumers are making minimum credit card payments.

- U.S. economy state weighs on little changed treasury yields.

- European markets predicted to sustain positive growth.

- Trump hints at imposing a 10% tariff on China starting in February.

- David Einhorn believes we are currently in the "Fartcoin" phase of the market cycle.