Super Micro appoints new auditor to retain Nasdaq listing, share price surges 23%

- Super Micro said on Monday that it hired BDO as its independent auditor.

- Since March, the stock has been declining, but it rose 23% in extended trading today, continuing its upward trend from earlier in the day.

- The Nasdaq will review the company's compliance plan before deciding whether to keep it listed.

Embattled server maker announced on Monday that it has appointed BDO as its new auditor and submitted a plan to Nasdaq detailing its efforts to regain compliance with the exchange. As a result, the shares surged 23% in extended trading.

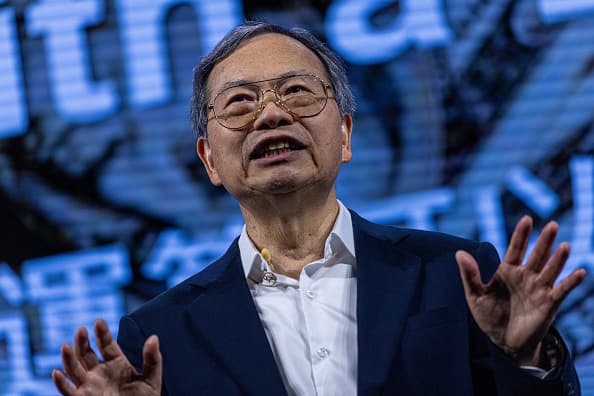

Charles Liang, CEO of Super Micro, stated that this step is crucial in updating our financial statements and we are doing it with both care and urgency.

Super Micro is currently behind schedule in submitting its 2024 year-end report to the SEC. The company announced earlier this month that it was seeking a new accountant following the resignation of its previous auditor, Ernst & Young, in October. Ernst & Young had only been with the company for a short time, replacing Deloitte & Touche as Super Micro's accounting firm in March 2023.

Super Micro informed Nasdaq that it expects to submit its annual report for the fiscal year ended June 30 and its quarterly report for the quarter ended September 30. The company stated that it will continue to be listed on Nasdaq while the exchange reviews its compliance plan.

Super Micro's shares surged more than 20 times in two years from early 2022 to March this year. However, the stock has been hit hard due to concerns about its compliance with Nasdaq. Its market cap, which was once valued at $70 billion, is now at $12.6 billion after a 16% rally during regular trading on Monday.

Due to its relationship with, Super Micro has experienced significant growth in sales, with a more than doubling of revenue to $15 billion in the last fiscal year.

On Monday, Super Micro announced that it was offering products that incorporate Nvidia's latest AI chip, Blackwell. The company competes with other vendors in providing access to Nvidia's AI technology.

In March, Super Micro was included in the S&P 500 due to its expanding business and rising stock value. Following the index's announcement, Super Micro reached its peak of $118.81 within two weeks.

The company faced issues within months, including the failure to file its annual report on time, a short position disclosed by Hindenburg Research, and a potential investigation by the Department of Justice.

Super Micro announced that it had been notified by Nasdaq that its delay in filing its annual report had resulted in a violation of the exchange's listing rules. The company was given 60 days to either file its report or submit a plan to regain compliance, with the deadline set for Monday.

WATCH: Super Micro is a sell due to accounting irregularities

Technology

You might also like

- SK Hynix's fourth-quarter earnings surge to a new peak, surpassing forecasts due to the growth in AI demand.

- Microsoft's business development chief, Chris Young, has resigned.

- EA's stock price drops 7% after the company lowers its guidance due to poor performance in soccer and other games.

- Jim Breyer, an early Facebook investor, states that Mark Zuckerberg has been rejuvenated by Meta's focus on artificial intelligence.

- Many companies' AI implementation projects lack intelligence.