Micron stock experiences its worst day since 2020 due to disappointing guidance.

- On Thursday, Micron's shares plummeted due to weaker-than-expected guidance for the second quarter.

- Stifel analysts reported that Micron anticipates a further delay in the PC refresh cycle and noted areas of increased customer inventory in smartphones.

- Still, data center revenue jumped 400%.

On Thursday, the shares of the chipmaker plummeted 16%, heading towards their worst day since March 2020 and the start of the Covid pandemic, after the company issued disappointing second-quarter guidance in its earnings report.

In early afternoon trading, the stock dropped to $86.78, representing a 45% decline from its June high.

Micron anticipates revenue of $7.9 billion, with a range of $5.9 billion to $9.9 billion, and adjusted earnings per share of $1.43, with a range of $1.33 to $1.53, for the fiscal second quarter. This is lower than the analysts' expectations of $8.98 billion in revenue and $1.91 in EPS, according to LSEG.

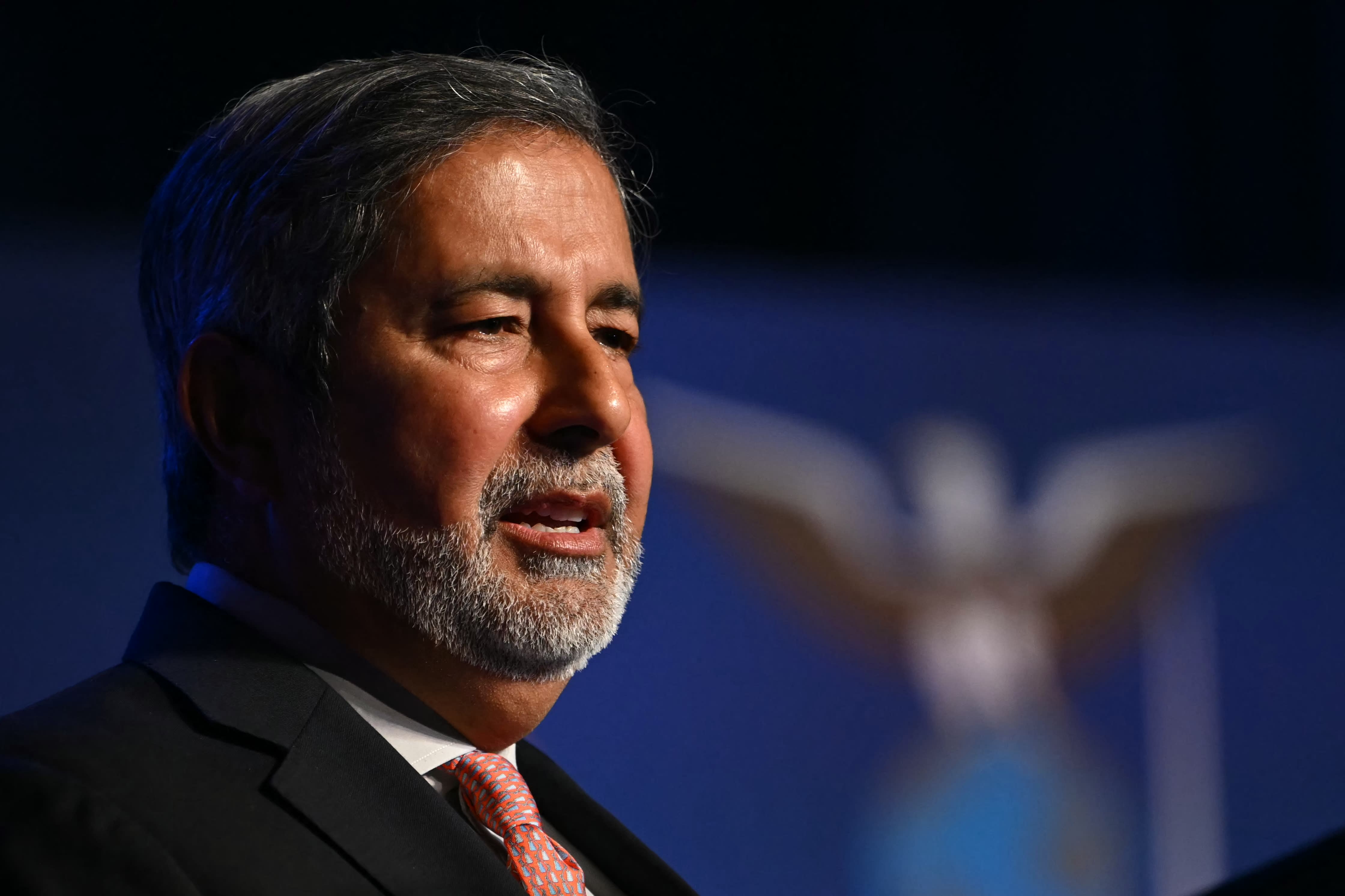

During the earnings call, CEO Sanjay Mehrotra stated that the company, which specializes in computer memory and storage, is observing a decline in growth in certain consumer device segments and is currently dealing with "inventory adjustments."

Stifel analysts predict a delay in the PC refresh cycle and noted high customer inventory in smartphones, keeping their buy rating on Micron but lowering their price target to $130 from $135.

Micron reported earnings per share of $1.79 in the first quarter, exceeding the average analyst estimate of $1.75. Revenue increased by 84% to $8.71 billion, matching expectations. The growth was primarily due to a 400% increase in data center revenue, driven by demand for artificial intelligence, Micron stated.

The company's report stated that it continues to gain market share in high-margin and strategic areas, and is well-positioned to utilize AI-driven growth to generate significant value for all stakeholders.

WATCH: Micron shares plunge

Technology

You might also like

- SK Hynix's fourth-quarter earnings surge to a new peak, surpassing forecasts due to the growth in AI demand.

- Microsoft's business development chief, Chris Young, has resigned.

- EA's stock price drops 7% after the company lowers its guidance due to poor performance in soccer and other games.

- Jim Breyer, an early Facebook investor, states that Mark Zuckerberg has been rejuvenated by Meta's focus on artificial intelligence.

- Many companies' AI implementation projects lack intelligence.