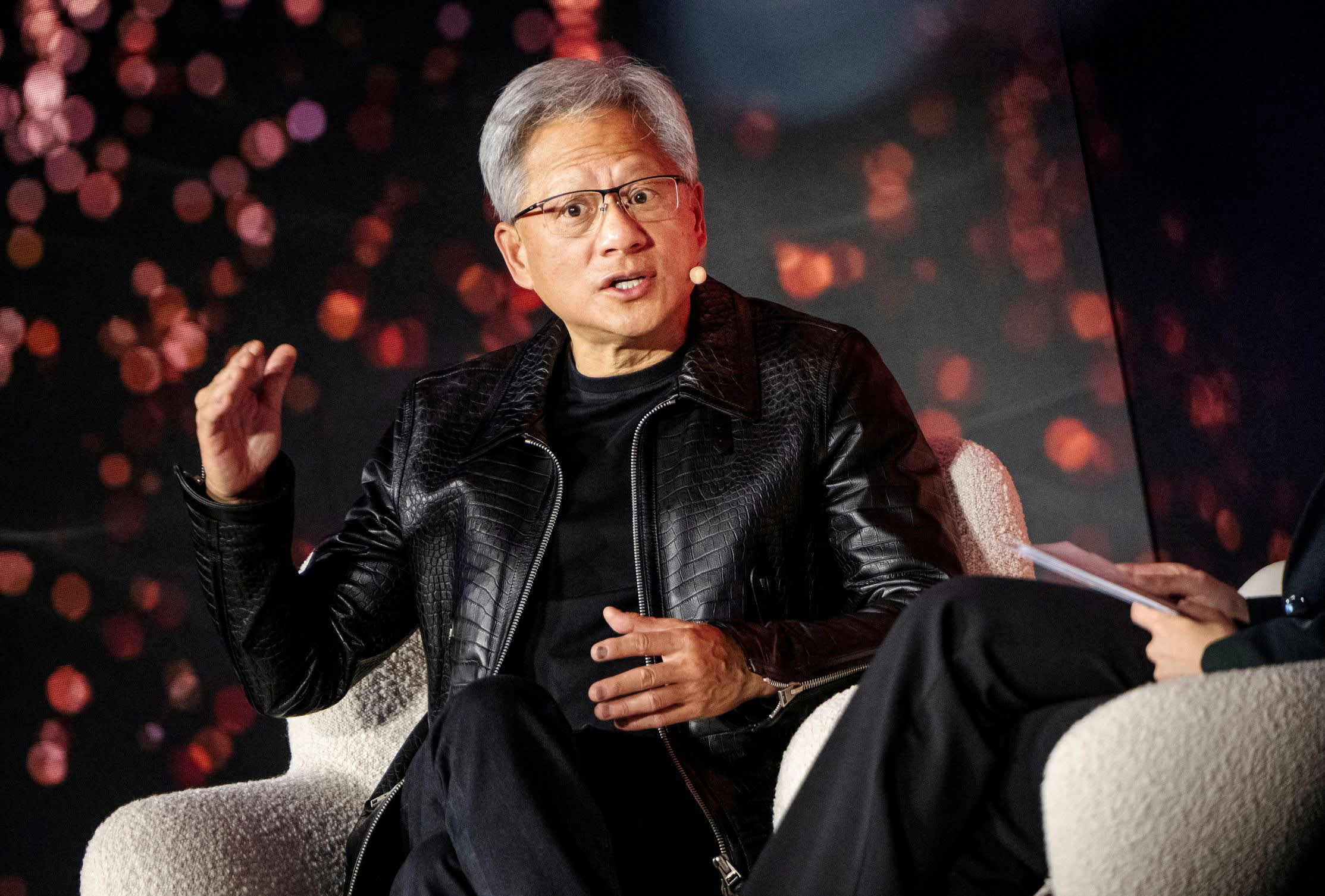

Intel to be replaced by Nvidia on the Dow Jones Industrial Average as a chipmaker.

- The Dow Jones Industrial Average is experiencing a shift as Nvidia replaces Intel, signaling a significant transformation in the semiconductor sector.

- This year, Nvidia shares have experienced a gain of more than 170%, while Intel has suffered a loss of over half its value.

- In February, the last change to the index was made, with the addition of fellow tech giant Amazon to the Dow.

The Dow Jones Industrial Average is experiencing a shakeup with the removal of a rival chipmaker, reflecting the growth of artificial intelligence and a significant shift in the semiconductor industry.

On Friday, in extended trading, Nvidia shares rose 1%, while Intel shares were down 1%.

The switch will occur on November 8th, as S&P Dow Jones announced in a statement.

Nvidia's AI chipmaker shares have surged over 170% in 2024, following a 240% increase last year, as investors have flocked to invest in the company. Nvidia's market value has skyrocketed to $3.3 trillion, making it the second most valuable publicly traded company after Apple.

Nvidia's revenue has more than doubled in each of the past five quarters, and has at least tripled in three of them. The company has sginaled that demand for its next-generation AI GPU called Blackwell is "insane." Companies including Microsoft, Meta, Google and Amazon are purchasing Nvidia's graphics processing units, such as the H100, in massive quantities to build clusters of computers for their AI work.

Nvidia's inclusion in the Dow has resulted in four of the six trillion-dollar tech companies being included in the index. The two companies not included are Alphabet and Meta.

Intel has been struggling with manufacturing challenges and new competition for its central processors, resulting in a 51% decline in its shares this year. Despite being the dominant maker of PC chips for long, Intel has lost market share to Advanced Micro Devices and has made little progress in AI. Meanwhile, Nvidia has been performing well.

This week, Intel disclosed that its board's audit and finance committee approved cost and capital reduction activities, including reducing its head count by 16,500 employees and lowering its real estate footprint. The job cuts were originally announced in August.

In May, Nvidia improved its position on the Dow by announcing a 10-for-1 stock split. This move did not change the company's market cap but reduced the price of each share by 90%, making it more accessible to the Dow without significantly impacting its weight.

Since February, the first change to the index has been the switch from Walgreens Boots Alliance to the index. Over time, the Dow has been lagging behind in exposure to the largest technology companies. The stocks in the DJIA are selected by a committee from S&P Dow Jones Indices.

This is breaking news. Please refresh for updates.

WATCH: Nvidia leaps and bounds ahead of AMD

Technology

You might also like

- SK Hynix's fourth-quarter earnings surge to a new peak, surpassing forecasts due to the growth in AI demand.

- Microsoft's business development chief, Chris Young, has resigned.

- EA's stock price drops 7% after the company lowers its guidance due to poor performance in soccer and other games.

- Jim Breyer, an early Facebook investor, states that Mark Zuckerberg has been rejuvenated by Meta's focus on artificial intelligence.

- Many companies' AI implementation projects lack intelligence.