Intel's earnings exceed expectations, and the company provides optimistic outlook, causing stock prices to rise by 15%.

- Intel reported better-than-expected revenue and issued uplifting guidance.

- But the company faced charges, partly from its restructuring.

- In the quarter, the chip manufacturer unveiled plans to spin off its foundry business as a separate subsidiary, allowing for external funding opportunities.

On Thursday, the shares of the chipmaker experienced a 15% increase in extended trading after it reported better-than-expected revenue and issued quarterly guidance that surpassed expectations.

Here's how the company did in comparison with LSEG consensus:

- Earnings per share: Loss of 46 cents adjusted

- Revenue: $13.28 billion vs. $13.02 billion expected

In the quarter that ended on Sept. 28, Intel reported a 6% decline in yearly revenue, resulting in a net loss of $16.99 billion, or $3.88 per share, compared to a net earnings of $310 million, or 7 cents per share, in the same quarter the previous year.

During the quarter, Intel recognized $2.8 billion in restructuring charges and $15.9 billion in impairment charges as part of its cost reduction plan.

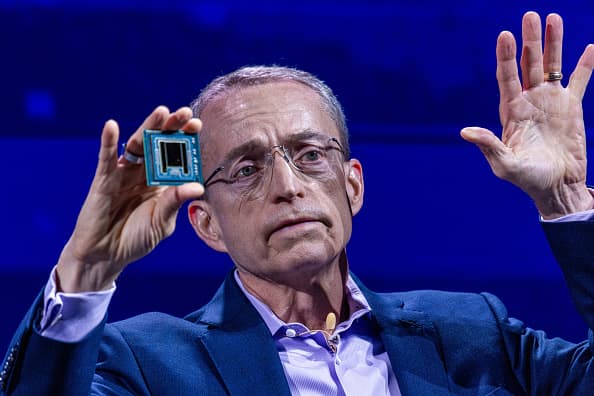

Intel has been experiencing a prolonged decline in its core businesses and struggles with breaking into the artificial intelligence market. CEO Pat Gelsinger announced plans to spin off the foundry business as an independent subsidiary, which could provide external funding opportunities.

Intel enlisted advisors to fend off activist investors, as reports emerged in late September that CNBC had contacted the company about a potential acquisition.

The revenue of the Client Computing Group, which sells PC chips, decreased by 7% from the previous year to $7.33 billion, falling below the $7.39 billion consensus among analysts surveyed by StreetAccount.

The Data Center and AI segment generated $3.35 billion in revenue, representing a 9% increase and surpassing the $3.17 billion consensus forecast from StreetAccount.

Intel forecasted adjusted earnings of 12 cents per share and revenue ranging from $13.3 billion to $14.3 billion for the fiscal third quarter, which exceeded analysts' expectations of 8 cents in earnings per share and $13.66 billion in revenue.

In the quarter, Intel unveiled the launch of Xeon 6 server processors and Gaudi artificial intelligence accelerators.

Intel shares had fallen by 57% as of Thursday's close in 2024, while the S&P 500 index had risen by 20%.

Analysts will receive a conference call from executives to discuss the results starting at 5 p.m. ET.

This is breaking news. Please check back for updates.

Paul Meeks of Harvest believes that Qualcomm buying Intel would be a poor decision.

Technology

You might also like

- SK Hynix's fourth-quarter earnings surge to a new peak, surpassing forecasts due to the growth in AI demand.

- Microsoft's business development chief, Chris Young, has resigned.

- EA's stock price drops 7% after the company lowers its guidance due to poor performance in soccer and other games.

- Jim Breyer, an early Facebook investor, states that Mark Zuckerberg has been rejuvenated by Meta's focus on artificial intelligence.

- Many companies' AI implementation projects lack intelligence.