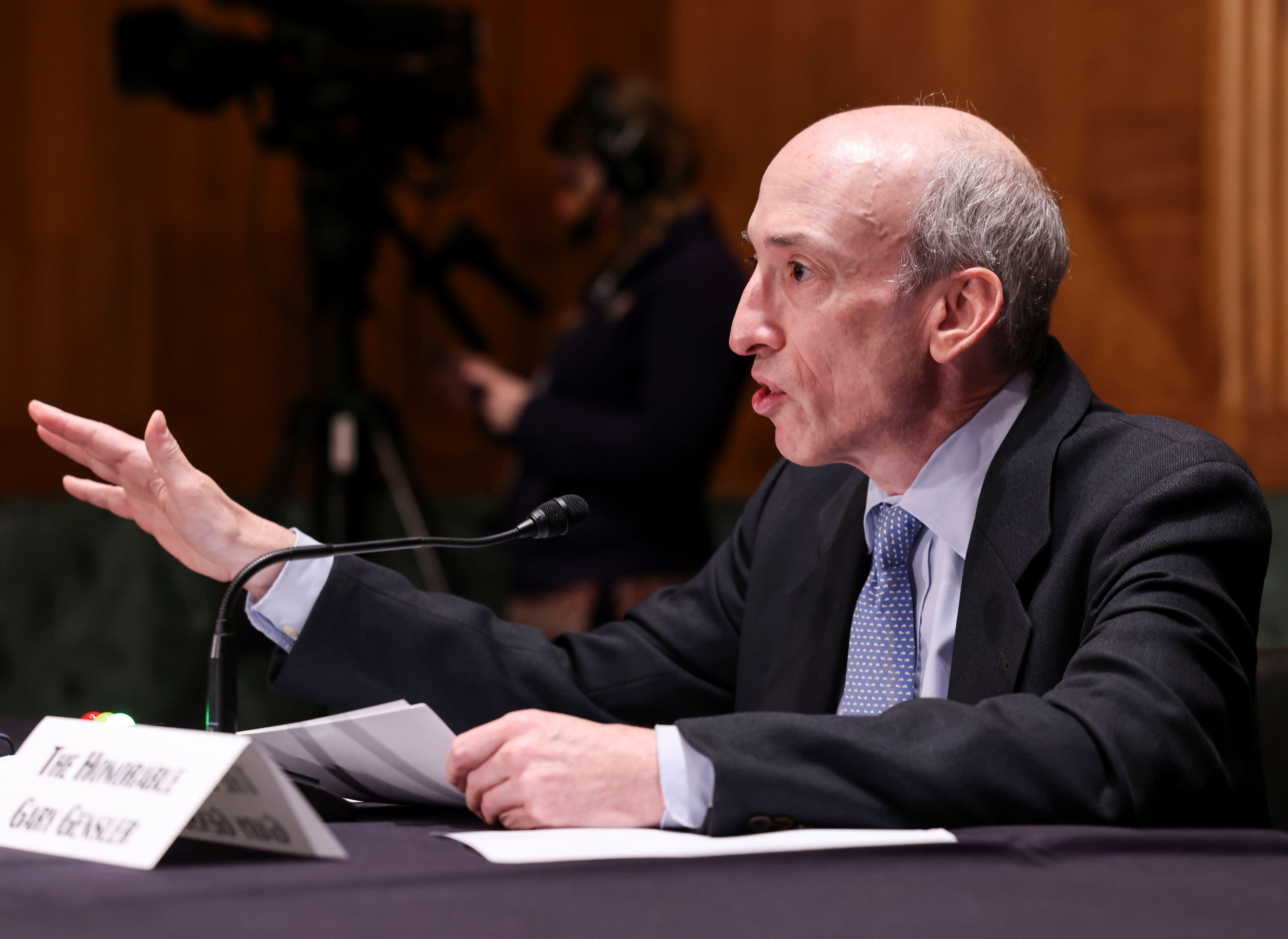

The SEC's proposed rule on short selling is aimed at increasing transparency.

The proposed new rule by the Securities and Exchange Commission aims to provide investors with more information about short sales, as part of a broader theme promoting greater transparency.

The SEC would require certain investment managers to report short-sale-related information to the commission on a monthly basis, and make the aggregate data available to the public for each individual security.

The SEC highlighted that the data would be aggregated to protect the privacy of individual managers and to enhance the existing publicly available short-sale data.

Since the stock price increased from $5 in October 2020 to over $400 in January 2021 due to a massive short squeeze, the SEC has become more interested in short sales.

The commission will now put out the proposed rule for public comment, allowing for modifications before finalizing it.

The SEC is currently considering over 50 proposed rules as part of its aggressive push to expand its regulatory reach, marking one of the largest regulatory drives in recent history.

The SEC has recently proposed additional disclosures from private funds, increased disclosure from companies regarding cybersecurity risks and attacks, more information on how corporations link executive pay to performance, and shortened the settlement cycle for stocks from two days to one.

markets

You might also like

- Delinquencies are on the rise while a record number of consumers are making minimum credit card payments.

- U.S. economy state weighs on little changed treasury yields.

- European markets predicted to sustain positive growth.

- Trump hints at imposing a 10% tariff on China starting in February.

- David Einhorn believes we are currently in the "Fartcoin" phase of the market cycle.