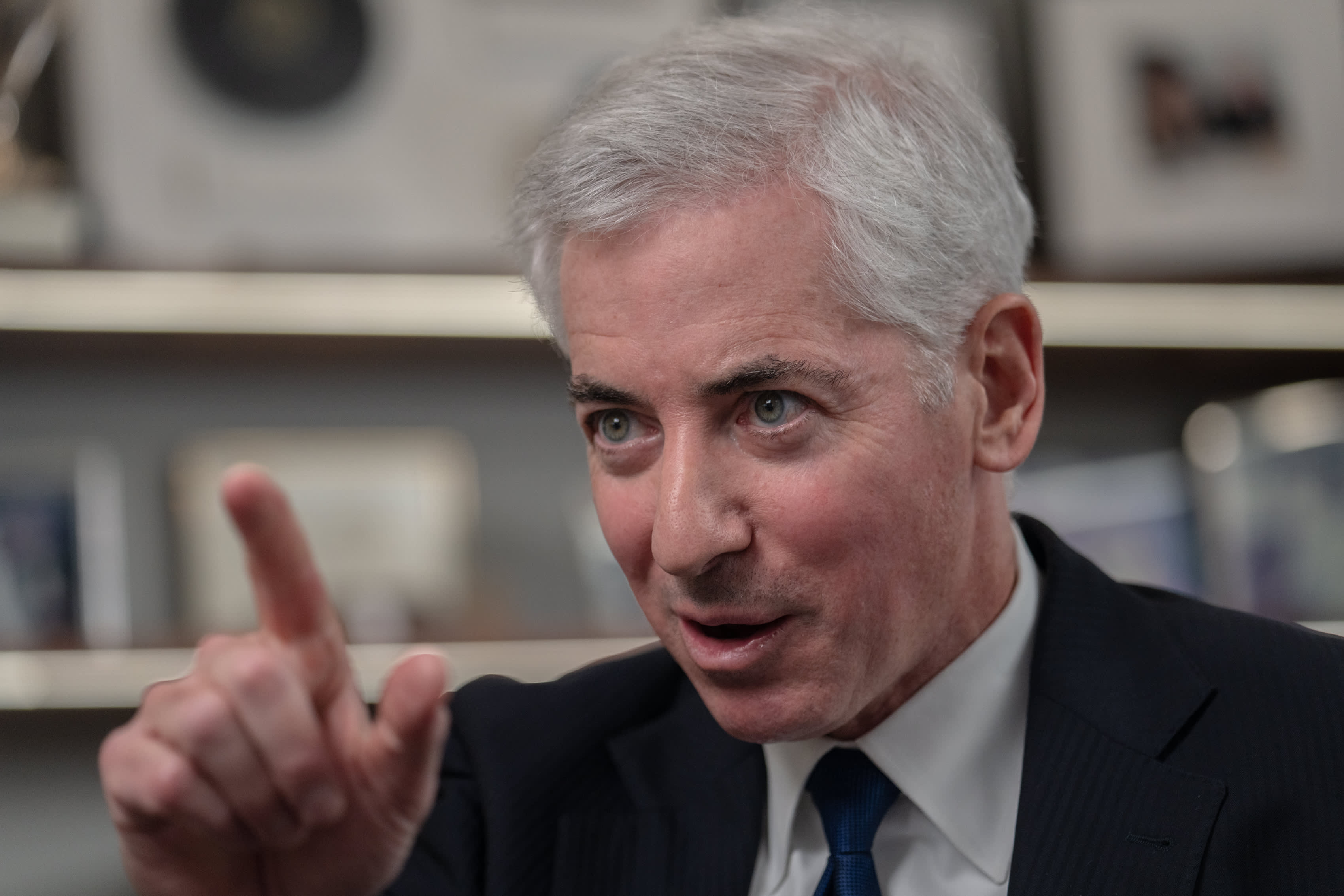

Pershing Square, led by Bill Ackman, withdraws IPO due to decreased demand.

- Pershing Square withdrew its IPO plans Wednesday afternoon amid low demand.

- Ackman stated that the company would provide an update when it is prepared to launch publicly.

Bill Ackman's Pershing Square USA abandoned plans for an initial public offering due to decreased investor demand from initial expectations.

The hedge fund titan stated that he would return with a revised plan for his fund, which he had intended to replicate after Berkshire Hathaway.

Wrote Ackman in a statement:

The billionaire investor delayed his IPO on the New York Stock Exchange last Friday, a day after the fund announced it would seek to raise $2 billion, below the previously reported $25 billion.

By the conclusion of June, Pershing Square managed $18.7 billion in assets, primarily through Pershing Square Holdings, a European-focused closed-end fund.

According to sources, Seth Klarman's Boston-based hedge fund Baupost Group decided not to invest in Ackman's new U.S. fund on Monday, as reported by Bloomberg News.

Ackman's decision to publicly list Pershing Square was viewed as a means of leveraging his growing influence among retail investors. With over 1 million followers on social media platform X, he has shared his opinions on a range of topics, including the U.S. presidential election and antisemitism.

Markets

You might also like

- Delinquencies are on the rise while a record number of consumers are making minimum credit card payments.

- U.S. economy state weighs on little changed treasury yields.

- European markets predicted to sustain positive growth.

- Trump hints at imposing a 10% tariff on China starting in February.

- David Einhorn believes we are currently in the "Fartcoin" phase of the market cycle.