Despite Prime Minister Ishiba's dovish turn, Japan is expected to continue its hiking cycle.

- Despite dovish comments from Japanese Prime Minister Shigeru Ishiba, Japanese currency experts remain firm in their expectations for the Bank of Japan's rate policy.

- On Wednesday, Prime Minister Shigeru Ishiba stated that he does not believe we are in an environment that would necessitate raising interest rates further, following a meeting with Bank of Japan Governor Kazuo Ueda.

Although Japanese Prime Minister Shigeru Ishiba made dovish remarks, market analysts remain firm in their expectations for the Bank of Japan's policy in the long term.

On Wednesday, the yen weakened to 147.15 against the dollar after Ishiba stated that the current economic climate did not necessitate an additional rate increase. The currency recorded its largest single-day decline since June 2022 during the session.

Ishiba stated on Wednesday that he does not think we need to raise interest rates any further, after meeting with Bank of Japan Governor Ueda, who heads the rate-setting committee at the bank. This represents a significant shift in tone from Ishiba's messaging during his recent campaign.

The prime minister's shift is significant because he has been a persistent critic of past Liberal Democratic Party administrations, including the late Abe Shinzo's, whose "Abenomics" was linked to monetary easing, according to Stefan Angrick, senior economist at Moody's Analytics.

Angrick stated on CNBC that he still believes in a rate hike in October, despite the BOJ's optimistic view of the economy in the latest September meeting minutes.

According to LSEG data, the futures market on Thursday indicated a less than 50% probability that the BOJ would increase interest rates by 10 basis points before the year's end.

BOJ board member Asahi Noguchi stated on Thursday morning that the central bank should maintain its accommodative monetary policy, as it will take time to alter the public's belief that prices will not rise significantly in the near future.

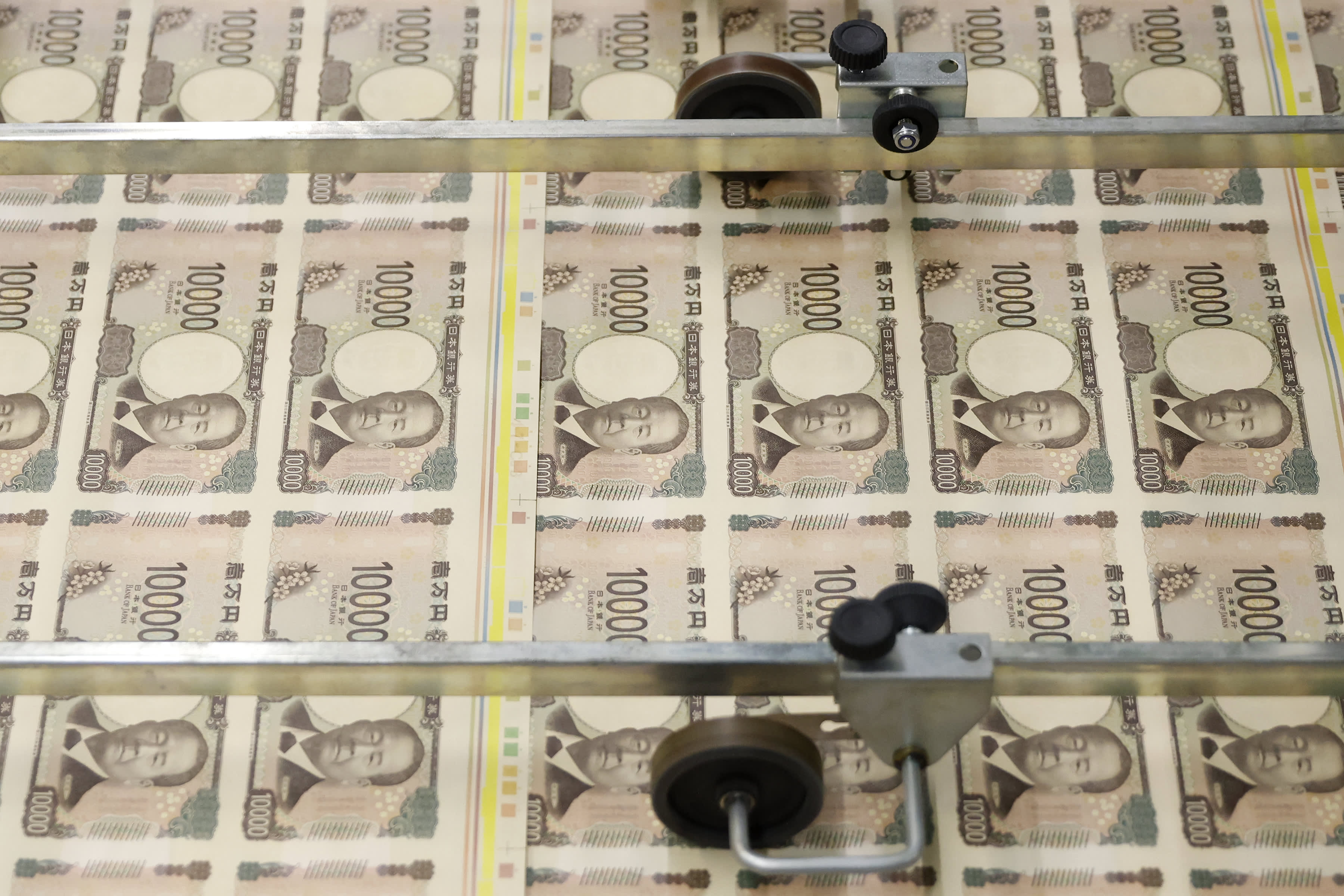

In September, the Bank of Japan maintained its benchmark interest rate at approximately 0.25%, which is the highest rate since 2008. On July 31, Japan's central bank increased its benchmark rate from its previous range of 0% to 0.1%. This was followed by the BOJ raising its policy rate for the first time in 17 years in March.

At the September meeting, BOJ board members disagreed on the future direction of interest rates, but the board acknowledged that Japan's economic activity and prices were in line with the Bank's projections.

The BOJ will review interest rates and provide updated quarterly forecasts for growth and prices during its next meeting on Oct. 30-31, followed by another meeting in December.

According to Ken Matsumoto, a macro strategist at Crédit Agricole CIB, the markets anticipated the Bank of Japan (BOJ) to increase its policy rate at the upcoming October meeting, given the alignment of the economic and inflation outlook. However, Matsumoto stated that Ishiba's announcement on Monday for a General Election to be held on October 27, which will determine the party controlling the parliament's lower house, has disrupted this expectation.

Matsumoto stated that he anticipates the BOJ to increase interest rates at the January meeting next year, rather than before. Meanwhile, Mazen Issa, a fixed income strategist at MRB Partners, said his firm "would not rule out another rate hike by the end of this year, but if not, the BOJ will hike by early 2025."

He stated that any future yen weakness is likely to be restricted.

The BOJ's decision to raise interest rates in July caused the unwinding of the popular yen carry trade, resulting in a sharp sell-off in global markets.

A strong yen, resulting from higher interest rates, can harm Japanese stock markets, particularly those with exporter-heavy indexes, as their exports become less competitive in the global market.

Since the spring, the BOJ and the government have been working together more closely, and are now attempting to promote a consolidation of the currency in the wake of the great yen carry unwind, as stated by Issa.

According to Nomura's Yujiro Goto, the BOJ is expected to increase interest rates by the end of 2025, but the specific timing will depend on three key factors.

The BOJ may raise interest rates in December, but only if the yen weakens, the U.S. avoids a hard landing, and the American economy remains stable after the presidential elections in November, according to Goto.

Mizuho's executive economist, Kazuo Momma, echoed this view.

The BOJ's actions will largely depend on exchange rate developments, which are significantly impacted by U.S. developments. If the yen remains stable or strengthens, the BOJ may wait until at least January 2025 before taking any action.

Markets

You might also like

- Delinquencies are on the rise while a record number of consumers are making minimum credit card payments.

- U.S. economy state weighs on little changed treasury yields.

- European markets predicted to sustain positive growth.

- Trump hints at imposing a 10% tariff on China starting in February.

- David Einhorn believes we are currently in the "Fartcoin" phase of the market cycle.