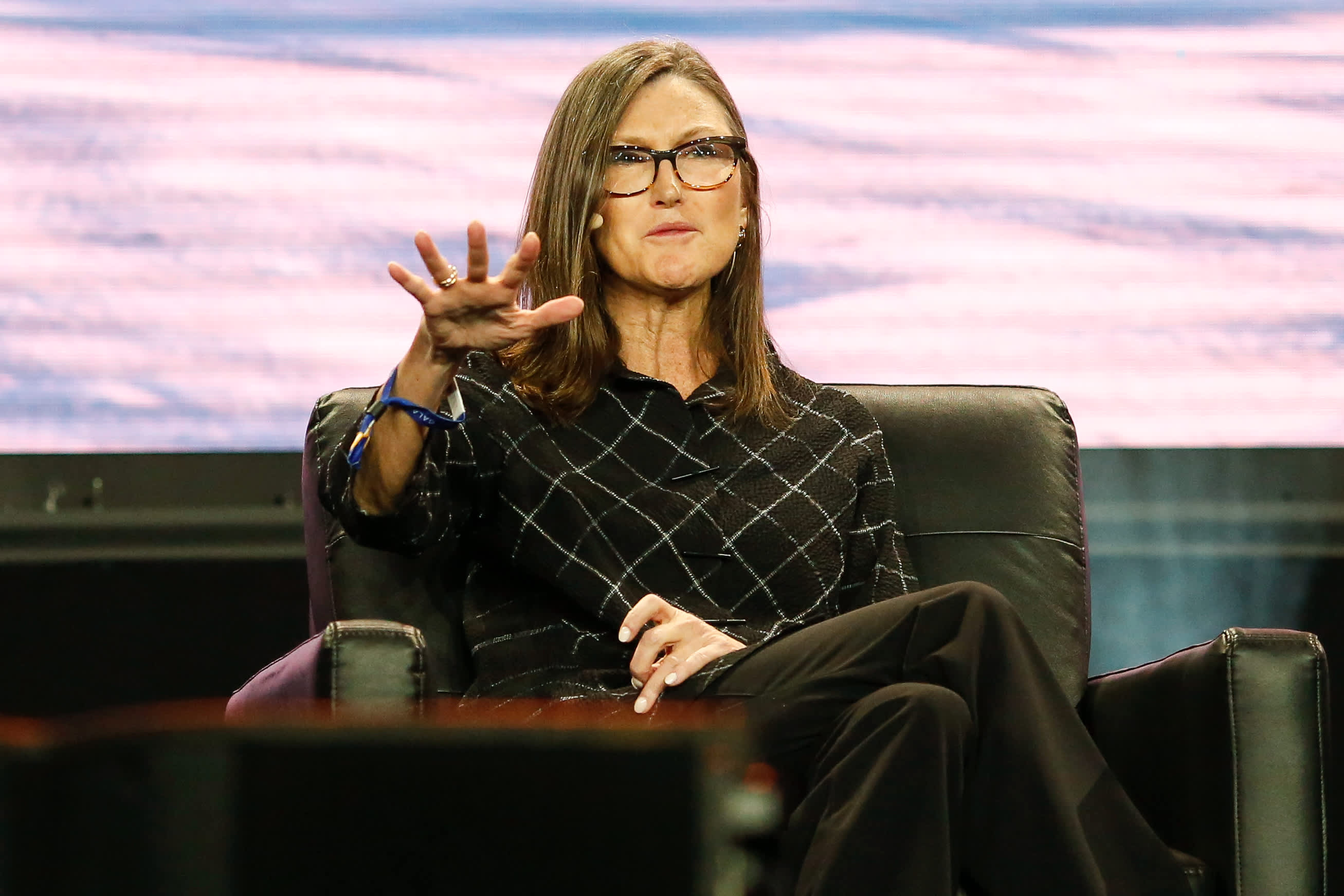

Cathie Wood discusses how the growth of artificial intelligence could drive the performance of Ark's Innovation ETF.

This week, Cathie Wood of Ark Invest stated that investors in her firm's flagship fund will benefit from the growth of the artificial intelligence industry.

"The dream of AI is now a reality," she told Bob Pisani on CNBC's "ETF Edge" on Monday. "We're ready for prime time."

As of Thursday's close, Ark's Innovation fund, which concentrates on cutting-edge technologies such as AI, has experienced a 17% increase in value this year. Despite this, the fund's growth has been outpaced by the broader market, which has surged 35% in the same time frame.

The ETF has not yet recovered from its all-time closing high on Feb. 12, 2021, which it is still more than 76% below.

Despite the Innovation ETF's decline over the past two years, Wood expressed optimism about the potential for AI-linked stocks in the fund. "Our confidence has only increased due to the advancements in artificial intelligence," she stated.

Wood advised investors to be careful with their AI investments. She highlighted the "Magnificent Seven" mega-cap tech stocks, except for , which is the ETF's top holding.

"We agree with Tesla that we are on the right horses, but we are not as certain about the others. We believe AI will be highly disruptive."

She proposed that the Ark Innovation ETF represented a wager on the future of AI, given the possibility of rapid advancements in AI interfaces leading to a new breed of industry leaders.

"As our companies grow, we believe that the element of surprise will be crucial in utilizing new platforms, ultimately leading to our return to portfolios."

markets

You might also like

- Delinquencies are on the rise while a record number of consumers are making minimum credit card payments.

- U.S. economy state weighs on little changed treasury yields.

- European markets predicted to sustain positive growth.

- Trump hints at imposing a 10% tariff on China starting in February.

- David Einhorn believes we are currently in the "Fartcoin" phase of the market cycle.