A strategist argues that China's valuations are undervalued.

- Inflation in China was recorded for the first time in February, following four months of deflation, as the consumer price index increased by 0.7% year-on-year after a 0.8% annual decline in January.

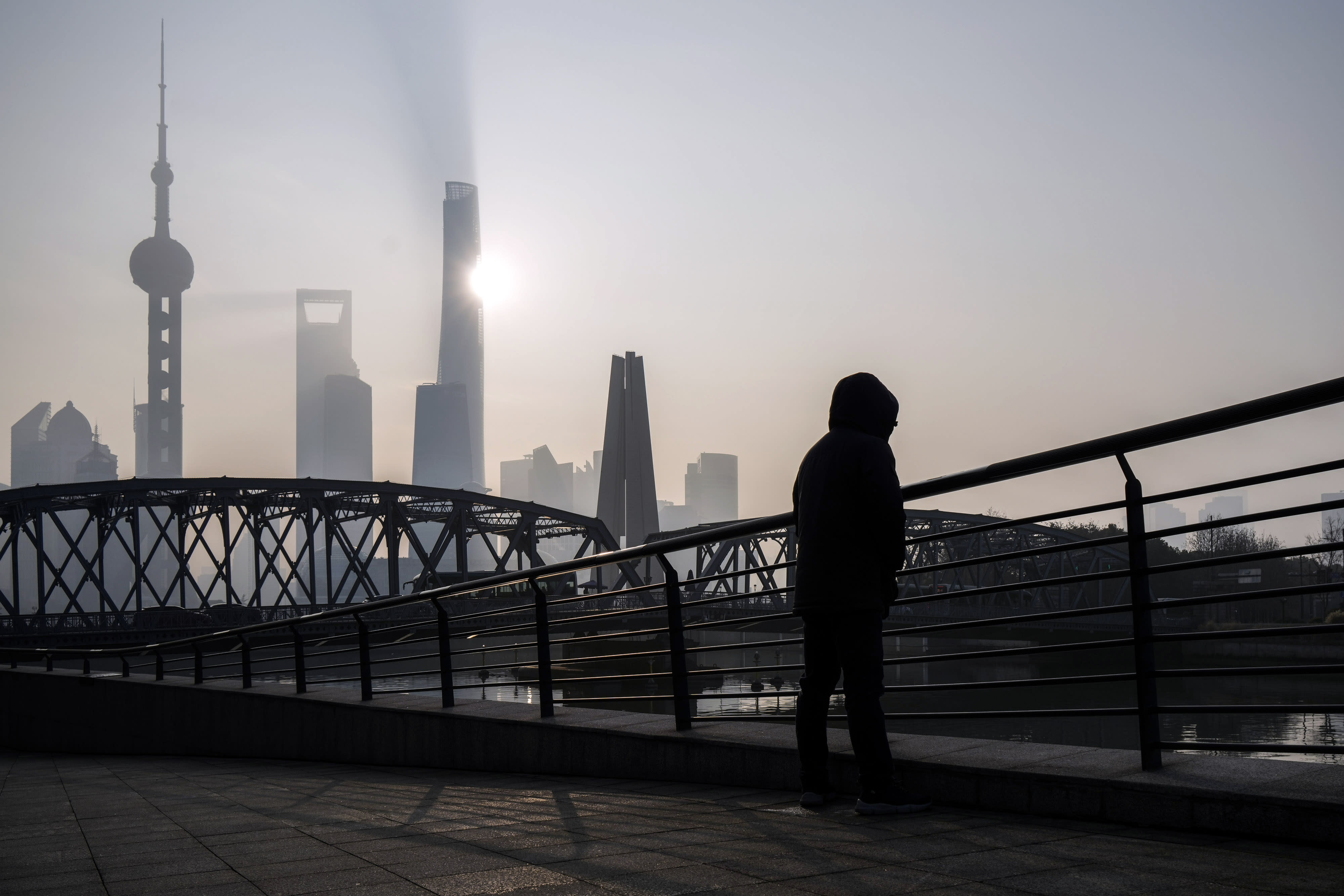

- Although there has been a slight increase in the past month, Hong Kong's Hang Seng index is still over 14% lower than it was a year ago, and Rein thinks "valuations are undervalued."

According to Shaun Rein, founder and managing director of the China Market Research Group, investors should be cautiously re-entering the world's second-largest economy as the valuations of Chinese stocks are "way too low."

Inflation in China was recorded for the first time in February, following four months of deflation, as the consumer price index increased by 0.7% year-on-year after a 0.8% annual decline in January.

The Lunar New Year period, according to Rein, is the time when deflation remains a threat to the Chinese economy.

According to Rein, Chinese consumers, particularly the wealthy ones, are still nervous and are trading down and skipping big ticket items, as seen on CNBC's "Squawk Box Europe" on Monday.

"Clearly, they're not going to launch a bazooka-like stimulus, as they're cautious about the government's decision."

In the short-term, global luxury brands may face challenges with decreased Chinese demand, while domestic NEV manufacturers may struggle.

The Chinese economy has faced challenges, resulting in declines in its stock markets over the past year. The government aims for 5% growth in 2024, with a growth rate of 5.2% in 2023.

According to Zichun Huang, a China economist at Capital Economics, the NPC Work Report last week's commitment to keeping 'money supply and credit growth in step with the real GDP and inflation targets' could indicate that policymakers will make more efforts to increase inflation towards the 3% target compared to the previous year.

"Although we believe China's low inflation is a result of its growth strategy based on high investment rates, we anticipate that inflation will remain low in the future as reducing dependence on investment is not yet imminent."

'Too early to call a bull market'

Rein stated that despite the short-term challenges, the measures being taken to shift the Chinese economy away from real estate and infrastructure are showing positive results, and the long-term outlook is optimistic.

If you're a multinational seeking to drive growth over the next three to five years, the next China is China. It's not India, which is only a sixth of China's GDP, nor Vietnam, which are small markets. Investors should look long-term at China again, as it's definitely investible.

"Despite the weak economy and the possibility of deflation in China, the job market is still weak, but the valuations are too low."

Although the Hang Seng index in Hong Kong has experienced a slight increase in the past month, it is still over 14% lower than it was a year ago. Rein stated that he started investing in Hong Kong-listed A-shares a month ago, believing that the valuations were undervalued.

Markets

You might also like

- Delinquencies are on the rise while a record number of consumers are making minimum credit card payments.

- U.S. economy state weighs on little changed treasury yields.

- European markets predicted to sustain positive growth.

- Trump hints at imposing a 10% tariff on China starting in February.

- David Einhorn believes we are currently in the "Fartcoin" phase of the market cycle.