Top Chinese leaders, including Xi, urge an end to real estate slump, addressing public worries.

- Top leaders in China have stated that they aim to put an end to the property market downturn, as reported in a readout of a high-level meeting published by state media on Thursday.

- The meeting was not detailed, but it is significant for a country where top-level policy directives are increasingly determined.

- The stock markets in mainland China and Hong Kong experienced significant growth following the release of positive news.

Top leaders in China have stated their goal to halt the property market decline, as reported in a readout of a high-level meeting published by state media on Thursday.

The Chinese readout stated that authorities "must take action to stop the real estate market decline and promote a steady recovery," while addressing the public's concerns.

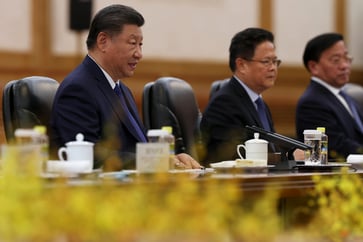

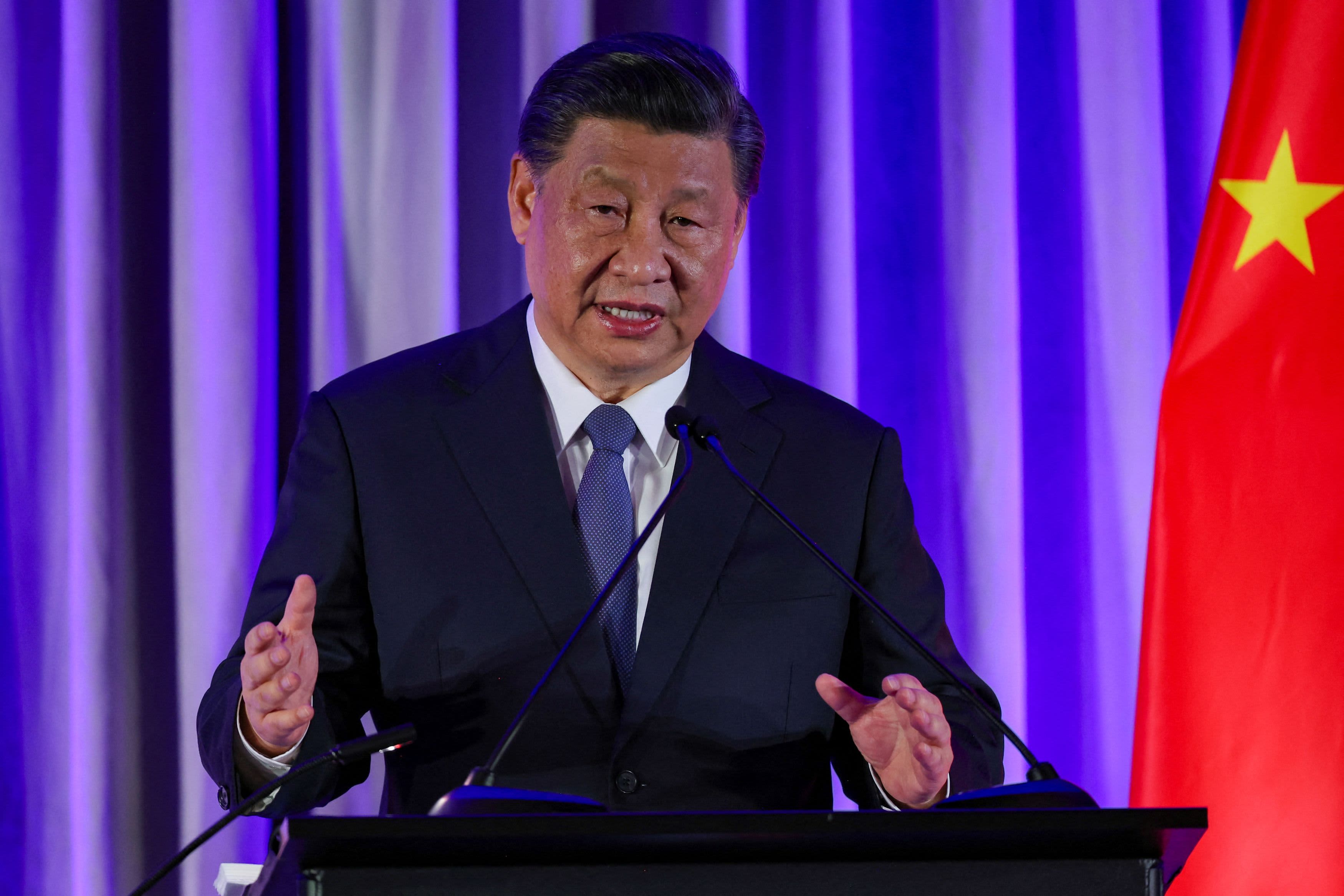

The Politburo, the second-highest circle of power in the ruling Chinese Communist Party, was led in a meeting on Thursday by Chinese President Xi Jinping, as reported by state media.

Leaders discussed the need for stronger fiscal and monetary policy support to address a range of issues, including employment and the aging population, without specifying the duration or magnitude of any actions.

"Zhiwei Zhang, president and chief economist at Pinpoint Asset Management, stated in an email to CNBC that he views the messages from the meeting as a positive step towards addressing the economic challenges. Although it takes time to formulate a comprehensive fiscal package, the meeting took one step in that direction."

The Chinese property stocks index in Hong Kong experienced a nearly 12% increase, causing stocks in mainland China and Hong Kong to extend gains and close higher on Thursday.

Since Beijing's crackdown in 2020 on developers' high levels of debt, real estate has accounted for less than a quarter of China's economy. The decline has also reduced local government revenue and household wealth.

The People's Bank of China announced interest rate cuts and real estate support just days after the U.S. cut interest rates, raising concerns about China's ability to meet its full-year GDP target of around 5% without additional stimulus. Despite the rise in stocks, analysts warned that the economy still needed fiscal support.

The decline in real estate has slightly moderated in recent months, with the value of new homes sold falling by 23.6% for the year through August, compared to the 24.3% drop year-to-date as of July.

In August, the average home prices decreased by 6.8% compared to the previous month on a seasonally adjusted basis, according to Goldman Sachs. This was a slight improvement from the 7.6% decline seen in July.

"To break the "wait-and-see" cycle, households will need to take action once bottom-out stabilization occurs in the housing market, according to Yue Su, principal economist China at the Economist Intelligence Unit. This suggests that the policy priority is not to increase housing prices to create wealth, but to encourage purchases. The real estate policy aims to reduce its negative impact on the economy."

The People's Bank of China announced on Tuesday that upcoming cuts in mortgage interest rates would reduce the mortgage payment burden by 150 billion yuan ($21.37 billion) annually.

The Thursday meeting was significant as it marked a trend of top-level decision-making for policy directives in the country.

Zong Liang, Bank of China's chief researcher, stated in Mandarin that the high-level meeting was held to establish an "overall policy" as there had been no prior meeting to consolidate the measures.

He observed that the meeting aligns with the market's positive reaction to the policy announcements earlier in the week. Zong anticipates Beijing will boost support, shifting from a focus on stability to taking action.

Tempering growth expectations

The meeting readout stated that China would diligently strive to achieve its full-year economic goals.

The Politburo meeting in July was less aggressive than the one in July, where the readout stated that China would work to achieve its goals "at all costs," according to Bruce Pang, chief economist and head of research for Greater China at JLL.

He stated that policymakers are seeking a balance between immediate growth and long-term solutions to tackle underlying problems.

In recent weeks, Goldman Sachs and other companies have revised their growth projections.

The EIU's Su stated that the change in tone about economic targets suggests that the government may accept growth below 5%, with an estimated real economic growth of 4.7% in 2024, followed by a slowdown to 4.5% (a moderate revision to our previous forecast).

She stated that Politburo meetings on economic deployment typically occur in April, July, and October.

"The earlier meeting and the focus on maintaining growth indicate policymakers' worries about the current economic growth rate."

Initial analyst reactions to Thursday's meeting readout were varied.

HSBC stated that "the tide has turned; be prepared for more proactive initiatives." In contrast, Capital Economics noted that Beijing's hint at stimulus did not provide clarity on whether it would involve large-scale fiscal support.

Earlier this year, S&P Global Ratings analysts stated in a report that fiscal stimulus is becoming less effective in China and is primarily used as a tactic to purchase time for achieving long-term objectives.

High-tech industry growth is necessary for the economy to transition to a higher-quality growth phase, according to senior officials who spoke to reporters in the summer.

— CNBC's Sonia Heng contributed to this report.

China Economy

You might also like

- Since Trump's first term, the number of Chinese investments in the U.S. has significantly decreased and it is unlikely to increase.

- Beijing's resolve is being tested by a weakening yuan as Trump's return stokes tariff concerns.

- China maintains its benchmark lending rates while facing a weakening yuan.

- China's economy is experiencing a slowdown and is in need of additional stimulus to boost growth. Here's how the country plans to revitalize its economy.

- The electric car market in China is predicted to decline in 2025.