China maintains stable benchmark lending rates while the Fed suggests fewer rate cuts in the future.

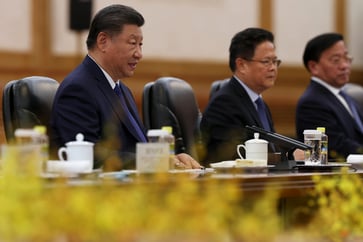

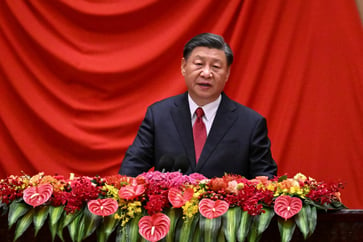

Beijing maintained its key lending rates on Friday, as it grapples with the task of boosting economic expansion while supporting a declining yuan.

The People's Bank of China announced that it would maintain the one-year loan prime rate at 3.1%, and the five-year LPR at 3.6%. The 1-year LPR influences corporate and most household loans, while the 5-year LPR serves as a benchmark for mortgage rates.

The U.S. Federal Reserve announced a 25-basis-points rate cut on Wednesday, which was widely expected. Additionally, the Fed revealed that it will only reduce interest rates twice in 2025, instead of the four cuts it had previously projected in its September meeting.

The Fed's revised outlook on future rate cuts may not significantly impact China's central bank's policy easing trajectory, but it could potentially affect the Chinese yuan's value.

Chinese officials have pledged to increase monetary easing measures, such as reducing interest rates, to strengthen the economy.

This is a breaking news story. Please refresh for updates.

— CNBC's Dylan Butts contributed to this report.

China Economy

You might also like

- Since Trump's first term, the number of Chinese investments in the U.S. has significantly decreased and it is unlikely to increase.

- Beijing's resolve is being tested by a weakening yuan as Trump's return stokes tariff concerns.

- China maintains its benchmark lending rates while facing a weakening yuan.

- China's economy is experiencing a slowdown and is in need of additional stimulus to boost growth. Here's how the country plans to revitalize its economy.

- The electric car market in China is predicted to decline in 2025.