Who would benefit from Trump's proposed tax break on car loan interest?

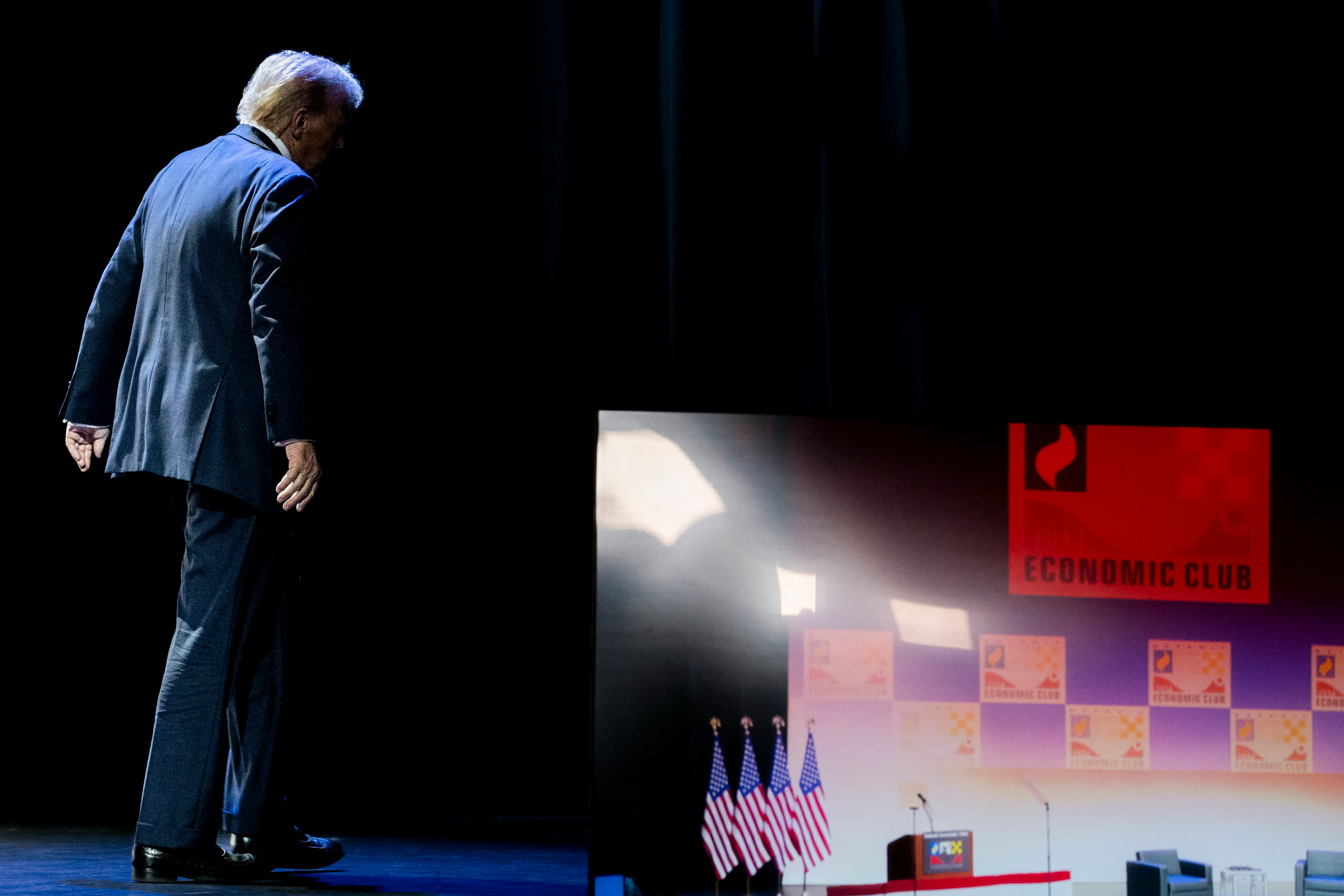

- Last week in Detroit, Donald Trump, the former president, suggested a new tax deduction for auto-loan interest.

- Tax and policy experts predict that the tax break would probably be in the form of an itemized deduction.

- Experts said that those who claim the deduction are likely to be wealthier households who purchase expensive cars.

Last week, former President Donald Trump suggested a new tax deduction for car owners who pay interest on an auto loan, which is among the several tax breaks he has proposed during his presidential campaign.

Trump's proposed tax break would enable car loan interest to be fully tax-deductible, similar to the mortgage interest deduction that reduces taxable income by writing off a portion of mortgage interest payments annually.

How many American households would gain from the benefit, and to what extent?

In the second quarter of 2024, over 100 million Americans had auto loans worth $1.63 trillion, with the average person owing approximately $24,000 on their car loan, according to the Federal Reserve Bank of New York and Experian, respectively.

According to AAA, someone purchasing a new vehicle this year can expect to pay approximately $1,332 annually in interest charges.

Some experts predict that the tax break plan, which Trump hasn't specified how it will be implemented, would mainly benefit wealthy Americans.

According to Jaret Seiberg, a financial services and housing policy analyst for TD Cowen Washington Research Group, the tax break "would mostly benefit wealthier individuals buying more expensive cars as one has to itemize their taxes to get the tax break."

According to Seiberg, entry-level car sales are unlikely to benefit because such buyers typically have "modest incomes" and claim a standard deduction on their tax returns.

The proposal is unlikely to receive support from many Democrats or Republicans in Congress, which must pass legislation to adopt the measure, according to Seiberg.

The Trump campaign declined to provide further information or comment on the proposal when requested by CNBC.

It would cost about $5 billion a year

In a speech in Detroit on Thursday, Trump likened the policy proposal to a federal tax deduction for home mortgage interest.

Homeowners can reduce their tax bill by deducting annual mortgage interest payments from their taxable income, but this tax break is only available to those who itemize deductions on their federal tax returns.

In 2025, the Social Security payroll tax limit will increase. Trump's tax cuts may expire after 2025. Taxpayers in 25 states have extra time to file their 2023 federal taxes.

Experts predict that an auto interest deduction would result in a significant loss for the federal government. According to Erica York, senior economist and research director at the Tax Foundation's Center for Federal Tax Policy, Trump's proposal on car loan interest would cost approximately $5 billion in income tax reductions annually if structured as an itemized deduction.

According to York's estimates, it would cost approximately $61 billion over a 10-year period, from 2025 to 2034.

Few taxpayers claim itemized tax deductions

To receive a deduction for borrowing costs, car owners must include them on their tax return.

Experts said that approximately 9 out of 10 taxpayers opt for the standard deduction rather than itemizing their deductions.

To receive a financial benefit, a taxpayer's total itemized deductions must exceed the standard deduction of $14,600 for single filers and $29,200 for married couples filing a joint tax return in 2024.

Nearly 15 million federal tax returns included an itemized deduction on their 2021 tax forms, according to the latest IRS statistics.

The 2017 tax law signed by President Trump decreased the number of taxpayers who claimed deductions.

Leonard Burman, an institute fellow at the Urban-Brookings Tax Policy Center, stated that an itemized tax break on car loan interest would only benefit a small percentage of taxpayers.

If auto loan interest were deductible, the percentage might increase slightly, but the majority of households would still not be able to benefit, and the ones that did would be disproportionately high-income filers, as Burman explained in an email.

In 2021, 62% of taxpayers who claimed itemized deductions had an adjusted gross income of $100,000 or more, according to IRS data. These taxpayers accounted for 77% of the total $660 billion in itemized deductions claimed that year.

Generally, individuals with more wealth receive greater financial benefits from tax deductions, according to York.

The value of the deduction is dependent on a household's marginal income tax rate, she stated.

According to Burman, a $1,332 tax deduction for someone in the 10% federal tax bracket would be worth about $133, while it'd be worth $493 to someone in the top 37% bracket.

Precedent for an itemized deduction

According to York of the Tax Foundation, there is precedent for treating a tax break on car loan interest as an itemized deduction.

The federal tax code permitted taxpayers to deduct "personal interest" expenses until the mid-1980s, which included interest on auto loans and credit cards, according to York.

However, Congress got rid of those deductions in 1986.

According to TurboTax, only a select few categories of interest payments are tax deductible, including interest on home loans, student loans, borrowing money for investment property, and interest incurred as a business expense.

Investing

You might also like

- In 2025, there will be a significant alteration to inherited IRAs, according to an advisor. Here's how to avoid penalties.

- An expert suggests that now is the 'optimal moment' to reevaluate your retirement savings. Here are some tips to help you begin.

- A human rights expert explains why wealth accumulation is increasing at an accelerated rate during the era of the billionaire.

- Social media influencers are here to stay, regardless of what happens with TikTok. Here's how to vet money advice from them.

- This tax season, investors may be eligible for free tax filing.